Chinese Consumers Spoiling Crude Oil Outlook

Share This Story, Choose Your Platform!

With so much focus on OPEC and geopolitical tensions, the mainstream crude oil narrative may be overlooking fundamental aspects that significantly influence long-term prices. If it seems like we’ve been curbing these rallies, it’s because we have. Our latest analysis explores how these fundamentals, particularly as highlighted in the latest EIA report dated July 10, 2024, suggest a similar outlook for crude oil as we have written on the CCR.

Crude Oil Inventories: High and Rising

U.S. commercial crude oil inventories decreased by 3.4 million barrels from the previous week, totaling 445.1 million barrels. While this might initially seem bullish, it’s crucial to note that the total crude oil stocks, including the Strategic Petroleum Reserve (SPR), increased by 3.0 million barrels. This suggests ample supply in the market, which could weigh on prices as we move further into the summer.

Numbers from China are getting worse

Concerns over the economy in China gained more steam as their Q2 GDP was weaker than expected for the q/q and y/y expectations. Data from the General Administration of Customs shows China’s oil product imports dropped 33.2% to a 20-month low. Shandong refineries have been operating at the lowest level since the pandemic began in 2020, according to JLC. The July IEA report shows that global demand has reached its slowest quarterly increase since 4Q22. Global supply and inventories rose, for a fourth consecutive month for the latter.

Even though China does not report the amount of oil going into their strategic reserve or inventory a reasonable guess is taking what was available to them by production and imports and subtracting refined throughputs. Using that math, approximately 900,000 bpd have been added to their inventory and/or reserves for 2024. We hinted at this in a previous article when the Russia/Ukraine war got underway, and China was likely adding a significant amount of oil to their reserves from Russia with sanctions providing heavily discounted oil to those who would take it. That proved to be the case as China reopened and the import volume was well short of the expectations many had. China’s domestic demand has increased to 4.37 million bpd in June, their highest in 9 years. Another key that imports will continue to fall for the largest oil importer.

OPEC updates

OPEC cuts of 2 m/bpd were extended until Q424 and are scheduled to fall off in the following 12 months. Iraq has admitted that it has overproduced 184,000 b/d over its OPEC+ quota and has said it will compensate for any overages for the 2024 year. It is well known that these countries produce more oil than they say they will, Iran just happened to get caught this time.

Rising Production and Imports

A key takeaway from the EIA report is the domestic crude oil production increase. Production rose by 100,000 barrels per day, reaching 13.3 million barrels per day. This uptick in production and a rise in crude oil imports (up by 214,000 barrels per day to 6.8 million barrels per day) indicate a robust supply scenario.

Over the past four weeks, crude oil imports averaged 6.7 million barrels per day, reflecting a 5.1% increase compared to the same period last year. This steady rise in imports and growing domestic production indicates that the availability of oil could surpass consumption, causing a potential decline in prices. Historically, basic economic principles demonstrate that prices generally decrease when the availability of goods increases relative to their consumption.

Refinery Activity and Product Inventories

The EIA report also highlights high refinery activity. U.S. crude oil refinery inputs averaged 17.1 million barrels per day, an increase of 317,000 barrels per day from the previous week. Refineries operated at 95.4% of their operable capacity, indicating vigorous processing activity.

Gasoline production rose, averaging 10.3 million barrels per day, with distillate fuel production also increasing to an average of 5.1 million barrels per day. Refineries are working at high capacity to meet expected consumption levels. However, if actual consumption falls short of these expectations, it could lead to an accumulation of inventories and subsequent price drops. This is similar to the scenario we discussed in our natural gas article last month.

Crude Futures Prices

West Texas Intermediate (WTI) crude oil was $84.44 per barrel on July 5, 2024, $1.61 higher than a week ago and $10.53 more than a year ago. While this increase might suggest bullish sentiment, it is crucial to consider the underlying fundamentals. The price increase could be driven by short-term factors such as geopolitical tensions or temporary disruptions in supply. Still, the overall data from the EIA report suggests ample supply in the market. Inventories below seasonal averages and high refinery rates make great headlines, but so far

The New York Harbor spot price for conventional gasoline increased to $2.579 per gallon, $0.052 more than a week ago. The increase in gasoline prices is likely driven by seasonal factors such as higher summer demand, but there will be downward pressure on prices if inventories rise going into the end of summer.

The national average retail price for regular gasoline rose to $3.489 per gallon on July 8, 2024, $0.010 above last week’s price and $0.057 less than the year-ago price. The modest increase suggests that consumer demand remains stable.

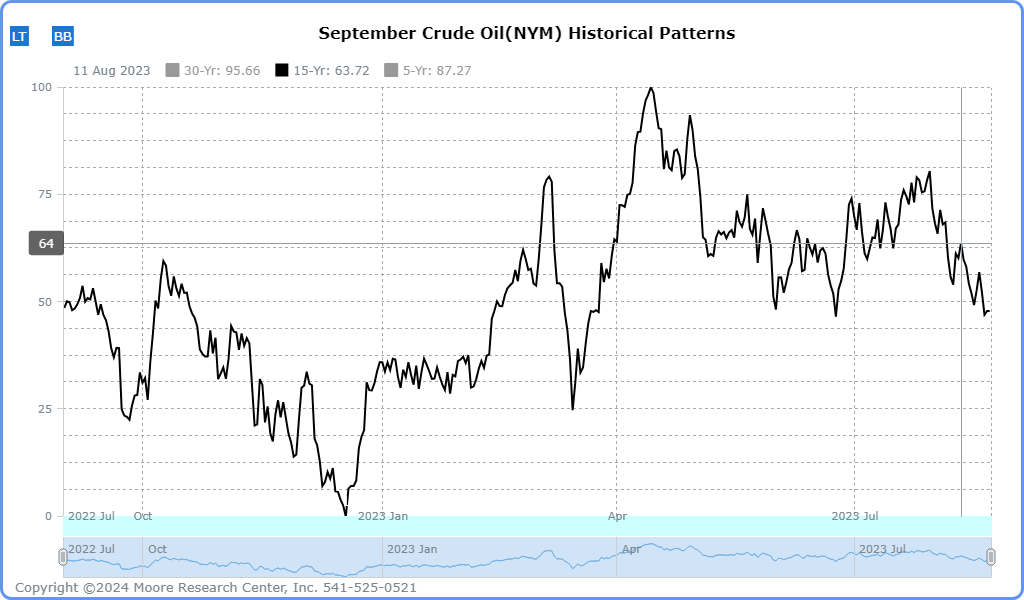

Seasonal Chart

As you may know, energy markets can see cyclical ebbs and flows in demand that can outsize price impacts. These cycles often coincide with the seasons of the year.

In crude oil, autumn marks the beginning of shoulder season. Shoulder season is a period of lower demand as driving season in the northern hemisphere has ended, while heating season has yet to begin. This has historically tended to correlate with a decline in the price of crude oil lasting into mid-winter. The chart below illustrates this tendency. (Past performance not indicative of future results.)

Oil prices have historically tended to decline into mid-winter as demand tends to weaken into autumn.

Drill baby, drill…Again!

Before the assassination attempt on former President Donald Trump, there was already an increasingly high chance he would once again become the President of the United States following the first debate. Those chances over the weekend are even more promising, which would be favorable for continued oil production in the United States. This potential political shift could have significant implications for the crude oil market, as a win for the former President could lead to increased oil production and lower prices. Both will be needed to fight off the persistent inflation and recession.

Monitoring Market Conditions

It is essential for traders to continually monitor market conditions, as various factors, including geopolitical events, changes in production quotas by OPEC, and unexpected shifts in demand, can influence the crude oil market. Staying informed and adjusting strategies as needed can help traders navigate the complexities of the crude oil market and maximize their potential for success. A fundamental long-term trader enjoys headlines that move prices $5 in one direction or another with added speculation creating opportunities.

Putting seasonals and fundamentals in your corner is an excellent place to start.

Final Thoughts

The latest EIA and IEA reports highlight several bearish fundamental indicators for crude oil, from rising production and imports to a slowing Chinese economy and increasing global product inventories. These factors suggest a potential situation that could pressure prices downward in the coming weeks. While temporary factors might influence short-term price movements, the underlying fundamentals indicate solid supply in the market.

Share This Story, Choose Your Platform!

Chinese Consumers Spoiling Crude Oil Outlook

Share This Story, Choose Your Platform

With so much focus on OPEC and geopolitical tensions, the mainstream crude oil narrative may be overlooking fundamental aspects that significantly influence long-term prices. If it seems like we’ve been curbing these rallies, it’s because we have. Our latest analysis explores how these fundamentals, particularly as highlighted in the latest EIA report dated July 10, 2024, suggest a similar outlook for crude oil as we have written on the CCR.

Crude Oil Inventories: High and Rising

U.S. commercial crude oil inventories decreased by 3.4 million barrels from the previous week, totaling 445.1 million barrels. While this might initially seem bullish, it’s crucial to note that the total crude oil stocks, including the Strategic Petroleum Reserve (SPR), increased by 3.0 million barrels. This suggests ample supply in the market, which could weigh on prices as we move further into the summer.

Numbers from China are getting worse

Concerns over the economy in China gained more steam as their Q2 GDP was weaker than expected for the q/q and y/y expectations. Data from the General Administration of Customs shows China’s oil product imports dropped 33.2% to a 20-month low. Shandong refineries have been operating at the lowest level since the pandemic began in 2020, according to JLC. The July IEA report shows that global demand has reached its slowest quarterly increase since 4Q22. Global supply and inventories rose, for a fourth consecutive month for the latter.

Even though China does not report the amount of oil going into their strategic reserve or inventory a reasonable guess is taking what was available to them by production and imports and subtracting refined throughputs. Using that math, approximately 900,000 bpd have been added to their inventory and/or reserves for 2024. We hinted at this in a previous article when the Russia/Ukraine war got underway, and China was likely adding a significant amount of oil to their reserves from Russia with sanctions providing heavily discounted oil to those who would take it. That proved to be the case as China reopened and the import volume was well short of the expectations many had. China’s domestic demand has increased to 4.37 million bpd in June, their highest in 9 years. Another key that imports will continue to fall for the largest oil importer.

OPEC updates

OPEC cuts of 2 m/bpd were extended until Q424 and are scheduled to fall off in the following 12 months. Iraq has admitted that it has overproduced 184,000 b/d over its OPEC+ quota and has said it will compensate for any overages for the 2024 year. It is well known that these countries produce more oil than they say they will, Iran just happened to get caught this time.

Rising Production and Imports

A key takeaway from the EIA report is the domestic crude oil production increase. Production rose by 100,000 barrels per day, reaching 13.3 million barrels per day. This uptick in production and a rise in crude oil imports (up by 214,000 barrels per day to 6.8 million barrels per day) indicate a robust supply scenario.

Over the past four weeks, crude oil imports averaged 6.7 million barrels per day, reflecting a 5.1% increase compared to the same period last year. This steady rise in imports and growing domestic production indicates that the availability of oil could surpass consumption, causing a potential decline in prices. Historically, basic economic principles demonstrate that prices generally decrease when the availability of goods increases relative to their consumption.

Refinery Activity and Product Inventories

The EIA report also highlights high refinery activity. U.S. crude oil refinery inputs averaged 17.1 million barrels per day, an increase of 317,000 barrels per day from the previous week. Refineries operated at 95.4% of their operable capacity, indicating vigorous processing activity.

Gasoline production rose, averaging 10.3 million barrels per day, with distillate fuel production also increasing to an average of 5.1 million barrels per day. Refineries are working at high capacity to meet expected consumption levels. However, if actual consumption falls short of these expectations, it could lead to an accumulation of inventories and subsequent price drops. This is similar to the scenario we discussed in our natural gas article last month.

Crude Futures Prices

West Texas Intermediate (WTI) crude oil was $84.44 per barrel on July 5, 2024, $1.61 higher than a week ago and $10.53 more than a year ago. While this increase might suggest bullish sentiment, it is crucial to consider the underlying fundamentals. The price increase could be driven by short-term factors such as geopolitical tensions or temporary disruptions in supply. Still, the overall data from the EIA report suggests ample supply in the market. Inventories below seasonal averages and high refinery rates make great headlines, but so far

The New York Harbor spot price for conventional gasoline increased to $2.579 per gallon, $0.052 more than a week ago. The increase in gasoline prices is likely driven by seasonal factors such as higher summer demand, but there will be downward pressure on prices if inventories rise going into the end of summer.

The national average retail price for regular gasoline rose to $3.489 per gallon on July 8, 2024, $0.010 above last week’s price and $0.057 less than the year-ago price. The modest increase suggests that consumer demand remains stable.

Seasonal Chart

As you may know, energy markets can see cyclical ebbs and flows in demand that can outsize price impacts. These cycles often coincide with the seasons of the year.

In crude oil, autumn marks the beginning of shoulder season. Shoulder season is a period of lower demand as driving season in the northern hemisphere has ended, while heating season has yet to begin. This has historically tended to correlate with a decline in the price of crude oil lasting into mid-winter. The chart below illustrates this tendency. (Past performance not indicative of future results.)

Oil prices have historically tended to decline into mid-winter as demand tends to weaken into autumn.

Drill baby, drill…Again!

Before the assassination attempt on former President Donald Trump, there was already an increasingly high chance he would once again become the President of the United States following the first debate. Those chances over the weekend are even more promising, which would be favorable for continued oil production in the United States. This potential political shift could have significant implications for the crude oil market, as a win for the former President could lead to increased oil production and lower prices. Both will be needed to fight off the persistent inflation and recession.

Monitoring Market Conditions

It is essential for traders to continually monitor market conditions, as various factors, including geopolitical events, changes in production quotas by OPEC, and unexpected shifts in demand, can influence the crude oil market. Staying informed and adjusting strategies as needed can help traders navigate the complexities of the crude oil market and maximize their potential for success. A fundamental long-term trader enjoys headlines that move prices $5 in one direction or another with added speculation creating opportunities.

Putting seasonals and fundamentals in your corner is an excellent place to start.

Final Thoughts

The latest EIA and IEA reports highlight several bearish fundamental indicators for crude oil, from rising production and imports to a slowing Chinese economy and increasing global product inventories. These factors suggest a potential situation that could pressure prices downward in the coming weeks. While temporary factors might influence short-term price movements, the underlying fundamentals indicate solid supply in the market.

Share This Story, Choose Your Platform!

Chinese Consumers Spoiling Crude Oil Outlook

Share This Story, Choose Your Platform

With so much focus on OPEC and geopolitical tensions, the mainstream crude oil narrative may be overlooking fundamental aspects that significantly influence long-term prices. If it seems like we’ve been curbing these rallies, it’s because we have. Our latest analysis explores how these fundamentals, particularly as highlighted in the latest EIA report dated July 10, 2024, suggest a similar outlook for crude oil as we have written on the CCR.

Crude Oil Inventories: High and Rising

U.S. commercial crude oil inventories decreased by 3.4 million barrels from the previous week, totaling 445.1 million barrels. While this might initially seem bullish, it’s crucial to note that the total crude oil stocks, including the Strategic Petroleum Reserve (SPR), increased by 3.0 million barrels. This suggests ample supply in the market, which could weigh on prices as we move further into the summer.

Numbers from China are getting worse

Concerns over the economy in China gained more steam as their Q2 GDP was weaker than expected for the q/q and y/y expectations. Data from the General Administration of Customs shows China’s oil product imports dropped 33.2% to a 20-month low. Shandong refineries have been operating at the lowest level since the pandemic began in 2020, according to JLC. The July IEA report shows that global demand has reached its slowest quarterly increase since 4Q22. Global supply and inventories rose, for a fourth consecutive month for the latter.

Even though China does not report the amount of oil going into their strategic reserve or inventory a reasonable guess is taking what was available to them by production and imports and subtracting refined throughputs. Using that math, approximately 900,000 bpd have been added to their inventory and/or reserves for 2024. We hinted at this in a previous article when the Russia/Ukraine war got underway, and China was likely adding a significant amount of oil to their reserves from Russia with sanctions providing heavily discounted oil to those who would take it. That proved to be the case as China reopened and the import volume was well short of the expectations many had. China’s domestic demand has increased to 4.37 million bpd in June, their highest in 9 years. Another key that imports will continue to fall for the largest oil importer.

OPEC updates

OPEC cuts of 2 m/bpd were extended until Q424 and are scheduled to fall off in the following 12 months. Iraq has admitted that it has overproduced 184,000 b/d over its OPEC+ quota and has said it will compensate for any overages for the 2024 year. It is well known that these countries produce more oil than they say they will, Iran just happened to get caught this time.

Rising Production and Imports

A key takeaway from the EIA report is the domestic crude oil production increase. Production rose by 100,000 barrels per day, reaching 13.3 million barrels per day. This uptick in production and a rise in crude oil imports (up by 214,000 barrels per day to 6.8 million barrels per day) indicate a robust supply scenario.

Over the past four weeks, crude oil imports averaged 6.7 million barrels per day, reflecting a 5.1% increase compared to the same period last year. This steady rise in imports and growing domestic production indicates that the availability of oil could surpass consumption, causing a potential decline in prices. Historically, basic economic principles demonstrate that prices generally decrease when the availability of goods increases relative to their consumption.

Refinery Activity and Product Inventories

The EIA report also highlights high refinery activity. U.S. crude oil refinery inputs averaged 17.1 million barrels per day, an increase of 317,000 barrels per day from the previous week. Refineries operated at 95.4% of their operable capacity, indicating vigorous processing activity.

Gasoline production rose, averaging 10.3 million barrels per day, with distillate fuel production also increasing to an average of 5.1 million barrels per day. Refineries are working at high capacity to meet expected consumption levels. However, if actual consumption falls short of these expectations, it could lead to an accumulation of inventories and subsequent price drops. This is similar to the scenario we discussed in our natural gas article last month.

Crude Futures Prices

West Texas Intermediate (WTI) crude oil was $84.44 per barrel on July 5, 2024, $1.61 higher than a week ago and $10.53 more than a year ago. While this increase might suggest bullish sentiment, it is crucial to consider the underlying fundamentals. The price increase could be driven by short-term factors such as geopolitical tensions or temporary disruptions in supply. Still, the overall data from the EIA report suggests ample supply in the market. Inventories below seasonal averages and high refinery rates make great headlines, but so far

The New York Harbor spot price for conventional gasoline increased to $2.579 per gallon, $0.052 more than a week ago. The increase in gasoline prices is likely driven by seasonal factors such as higher summer demand, but there will be downward pressure on prices if inventories rise going into the end of summer.

The national average retail price for regular gasoline rose to $3.489 per gallon on July 8, 2024, $0.010 above last week’s price and $0.057 less than the year-ago price. The modest increase suggests that consumer demand remains stable.

Seasonal Chart

As you may know, energy markets can see cyclical ebbs and flows in demand that can outsize price impacts. These cycles often coincide with the seasons of the year.

In crude oil, autumn marks the beginning of shoulder season. Shoulder season is a period of lower demand as driving season in the northern hemisphere has ended, while heating season has yet to begin. This has historically tended to correlate with a decline in the price of crude oil lasting into mid-winter. The chart below illustrates this tendency. (Past performance not indicative of future results.)

Oil prices have historically tended to decline into mid-winter as demand tends to weaken into autumn.

Drill baby, drill…Again!

Before the assassination attempt on former President Donald Trump, there was already an increasingly high chance he would once again become the President of the United States following the first debate. Those chances over the weekend are even more promising, which would be favorable for continued oil production in the United States. This potential political shift could have significant implications for the crude oil market, as a win for the former President could lead to increased oil production and lower prices. Both will be needed to fight off the persistent inflation and recession.

Monitoring Market Conditions

It is essential for traders to continually monitor market conditions, as various factors, including geopolitical events, changes in production quotas by OPEC, and unexpected shifts in demand, can influence the crude oil market. Staying informed and adjusting strategies as needed can help traders navigate the complexities of the crude oil market and maximize their potential for success. A fundamental long-term trader enjoys headlines that move prices $5 in one direction or another with added speculation creating opportunities.

Putting seasonals and fundamentals in your corner is an excellent place to start.

Final Thoughts

The latest EIA and IEA reports highlight several bearish fundamental indicators for crude oil, from rising production and imports to a slowing Chinese economy and increasing global product inventories. These factors suggest a potential situation that could pressure prices downward in the coming weeks. While temporary factors might influence short-term price movements, the underlying fundamentals indicate solid supply in the market.