Coffee Market Hits New Highs

Share This Story, Choose Your Platform!

Coffee Market Update: Challenges in Brazil as Prices Hit New Highs

The coffee market is experiencing rising prices, particularly in the Robusta segment, as global supply concerns dominate discussions. Meanwhile, on-the-ground reports from Brazil provide a clearer picture of the struggles coffee growers face, which are likely to persist until the rains arrive.

Robusta Prices Increase Amid Supply Concerns

Robusta coffee prices have reached new highs, driven by ongoing concerns about global supply. These price movements reflect the strain on the market, particularly as major producers like Brazil and Vietnam navigate challenging conditions. The rise in Robusta prices underscores the impact of these supply issues, although the market remains cautious and is awaiting further developments.

Vietnamese Crop: Stable Outlook

In contrast to the situation in Brazil, Vietnam’s coffee crop outlook remains stable. “The Vietnamese crop is looking much better with excellent weather lately,” says Judy Ganes, President of J Ganes Consulting. The country, a significant producer of Robusta, has benefited from favorable weather, leading to expectations of a strong harvest this season. While this stability in Vietnam’s production offers some balance to the market, challenges remain in other key regions, particularly Brazil.

Brazilian Coffee Fields: Ongoing Struggles

Reports from Brazil indicate that coffee fields are under significant stress due to prolonged drought and high temperatures. These conditions have been particularly harsh in areas with higher yields, where the size of the beans is expected to be smaller than usual. The drought’s impact also extends into the 2025 season, especially in regions where production is typically strong.

According to Jonas Ferraresso, an agronomist on the ground in Brazil, “the climate issues have affected Arabica coffee plants in various ways depending on the time of year and the plant’s growth phase. For the 2024 crop, high temperatures during the development of the coffee fruits reduced the photosynthetic rate of the plants, resulting in smaller fruits that have already been harvested.” Ferraresso explains that “if this scenario continues until the end of September, we may have a problem with flowering, leading to fewer fruits per plant and a smaller harvest in 2025.”

The lack of recent rainfall has left many trees in a vulnerable state, with some crops already showing signs of damage that may not be recoverable. Ferraresso notes, “At the moment, the water deficit in coffee plantations is serious and premature. If the rains arrive in adequate volumes, at least 40 mm in the next 15 days, part of the damage can be recovered. However, a full harvest might only be possible in 2026.”

Market Focus: Eagerly Awaiting the Rain

The current focus in the coffee market is on the upcoming rainy season in Brazil. Historically, rain has played a significant role in determining the health and yield of coffee crops, and this year is no different. The last rainfall in many regions ended earlier than expected, and the trees are now waiting for the next round of rain, anticipated to start within the next few weeks. With below average rain during the early months of this year and elevated temperatures the markets run to new highs proves there is real concern over the health of the trees.

Until the rains arrive and relieve the fields, coffee futures prices will likely remain elevated. The market is closely watching weather forecasts, and any signs of delayed or insufficient rainfall could sustain or even drive prices higher. Last year, similar concerns about the crop last year persisted until the rains came.

“London is now reacting to all the talk of Brazil Conilon being hurt but I’m not entirely buying into it. Same was said last year and the crop exceeded expectations.” says Ganes.

This year, traders and market participants should watch the weather closely. The timing and intensity of the upcoming rains will be critical in shaping the market’s direction, as they will determine whether the current concerns about the crop are alleviated or exacerbated.

Seasonality Trends

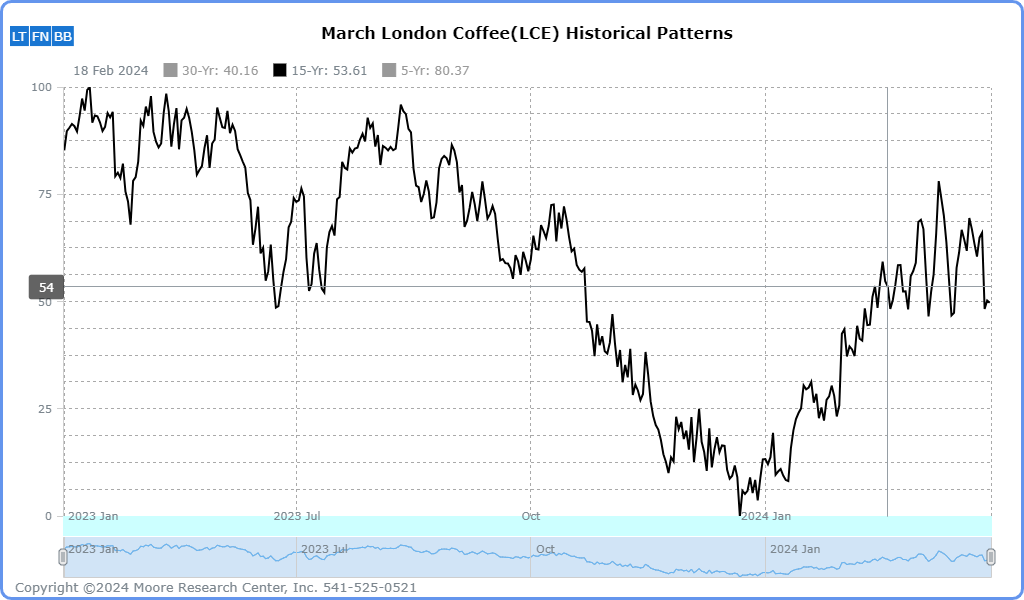

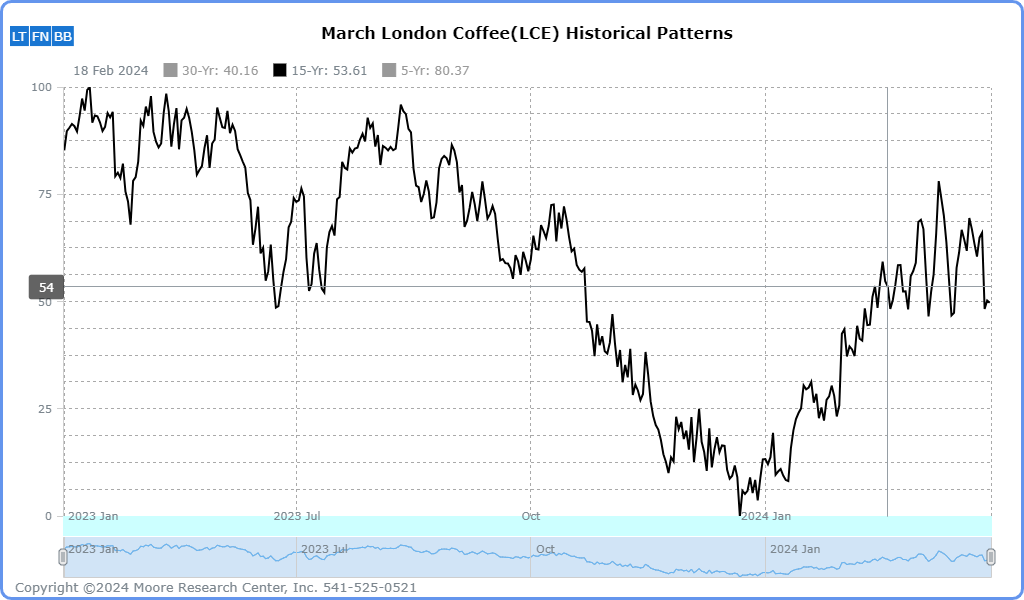

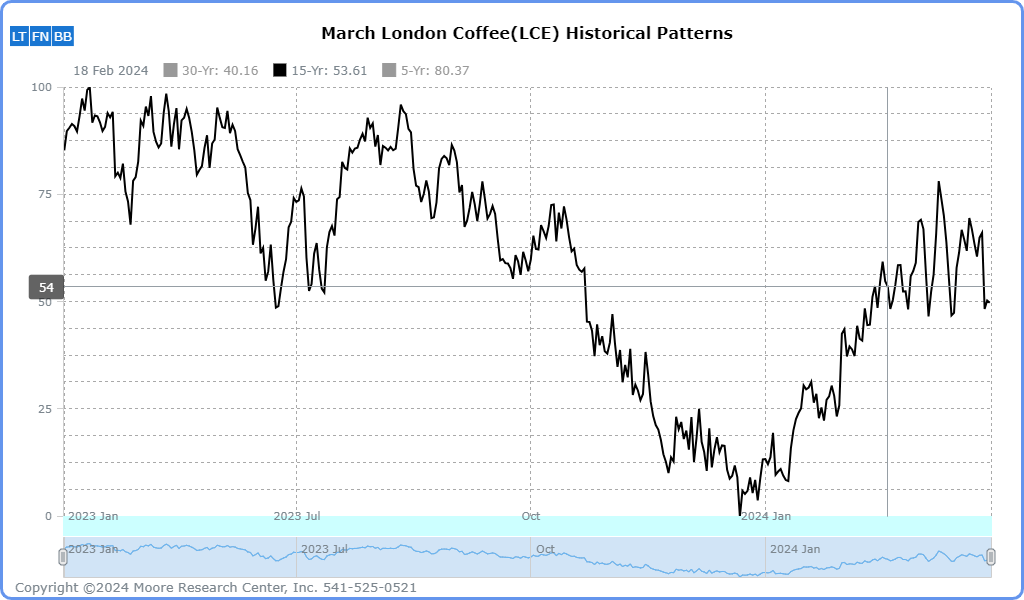

Robusta coffee, known for its higher caffeine content and use in instant coffee and espresso blends, exhibits distinct seasonal price patterns. Several factors, including harvest cycles, weather conditions in key producing countries, and global demand dynamics influence seasonality in Robusta.

Typically, Robusta prices experience lower points during the main harvest seasons in major producing countries like Vietnam and Brazil. The influx of fresh supplies during these periods can lead to a temporary softening of prices. However, as the year progresses, particularly after the harvest is completed, prices often begin to rise. This increase is driven by concerns over the availability of future supplies, mainly if reports of adverse weather conditions affect the next crop.

Seasonal Chart by Moore Research.

In the first half of the year, Robusta prices usually stabilize or even decline as harvests in Vietnam, the world’s largest Robusta producer, flood the market. By mid-year, however, the market often shifts its focus to the upcoming crop season and potential risks. This is when prices start climbing, reflecting the market’s anticipation of possible supply disruptions due to weather or other factors.

The latter half of the year is often characterized by increased price volatility. This is particularly true if there are reports of droughts, excessive rainfall, or other climatic events that could impact the next harvest. As traders and investors react to these reports, prices can spike, particularly if there is uncertainty about the quality or quantity of the next crop.

Given the current conditions in Brazil and Vietnam, where weather has significantly shaped market expectations, we might see Robusta prices continue to exhibit this seasonal pattern. If the forecasts are true and the rain comes, it would again prove the above seasonal to be right.

Strategic Considerations: Actively monitoring Developments

For traders and investors, the key takeaway is the importance of closely monitoring weather developments in Brazil. The market is currently reacting to the challenges faced by coffee growers, but the situation could change quickly if the rains arrive as expected. As Ferraresso pointed out, “a yellow warning light is already on,” signaling the potential severity of the situation for the 2025 harvest.

Historically, we have seen these patterns before. While the extreme heat conditions are a concern, rain is forecasted in the areas that need it most. Photos have shown flowering covering hectares and hectares; we believe the rains will come in time. The cherries may be smaller, but quantity will more than likely make up for it.

Fundamentally, global production is on track to be greater than demand and should increase stockpiles. Reports of Brazil exporting 700,000 more bags in July vs a year ago, a 26% increase. Total exports for Brazil are up 46% YOY. Those reports are strong indicators that the 2024/25 season was not as bad as CONAB would like us to think. Rabobank is reporting 67.1m bags, still a substantial crop.

Given the current market dynamics, traders should remain vigilant. While opportunities exist in both Robusta and Arabica markets, the ongoing volatility and weather-related risks require careful consideration. Strategic positioning and risk management will be essential in navigating this environment.

Share This Story, Choose Your Platform!

Coffee Market Hits New Highs

Share This Story, Choose Your Platform

Coffee Market Update: Challenges in Brazil as Prices Hit New Highs

The coffee market is experiencing rising prices, particularly in the Robusta segment, as global supply concerns dominate discussions. Meanwhile, on-the-ground reports from Brazil provide a clearer picture of the struggles coffee growers face, which are likely to persist until the rains arrive.

Robusta Prices Increase Amid Supply Concerns

Robusta coffee prices have reached new highs, driven by ongoing concerns about global supply. These price movements reflect the strain on the market, particularly as major producers like Brazil and Vietnam navigate challenging conditions. The rise in Robusta prices underscores the impact of these supply issues, although the market remains cautious and is awaiting further developments.

Vietnamese Crop: Stable Outlook

In contrast to the situation in Brazil, Vietnam’s coffee crop outlook remains stable. “The Vietnamese crop is looking much better with excellent weather lately,” says Judy Ganes, President of J Ganes Consulting. The country, a significant producer of Robusta, has benefited from favorable weather, leading to expectations of a strong harvest this season. While this stability in Vietnam’s production offers some balance to the market, challenges remain in other key regions, particularly Brazil.

Brazilian Coffee Fields: Ongoing Struggles

Reports from Brazil indicate that coffee fields are under significant stress due to prolonged drought and high temperatures. These conditions have been particularly harsh in areas with higher yields, where the size of the beans is expected to be smaller than usual. The drought’s impact also extends into the 2025 season, especially in regions where production is typically strong.

According to Jonas Ferraresso, an agronomist on the ground in Brazil, “the climate issues have affected Arabica coffee plants in various ways depending on the time of year and the plant’s growth phase. For the 2024 crop, high temperatures during the development of the coffee fruits reduced the photosynthetic rate of the plants, resulting in smaller fruits that have already been harvested.” Ferraresso explains that “if this scenario continues until the end of September, we may have a problem with flowering, leading to fewer fruits per plant and a smaller harvest in 2025.”

The lack of recent rainfall has left many trees in a vulnerable state, with some crops already showing signs of damage that may not be recoverable. Ferraresso notes, “At the moment, the water deficit in coffee plantations is serious and premature. If the rains arrive in adequate volumes, at least 40 mm in the next 15 days, part of the damage can be recovered. However, a full harvest might only be possible in 2026.”

Market Focus: Eagerly Awaiting the Rain

The current focus in the coffee market is on the upcoming rainy season in Brazil. Historically, rain has played a significant role in determining the health and yield of coffee crops, and this year is no different. The last rainfall in many regions ended earlier than expected, and the trees are now waiting for the next round of rain, anticipated to start within the next few weeks. With below average rain during the early months of this year and elevated temperatures the markets run to new highs proves there is real concern over the health of the trees.

Until the rains arrive and relieve the fields, coffee futures prices will likely remain elevated. The market is closely watching weather forecasts, and any signs of delayed or insufficient rainfall could sustain or even drive prices higher. Last year, similar concerns about the crop last year persisted until the rains came.

“London is now reacting to all the talk of Brazil Conilon being hurt but I’m not entirely buying into it. Same was said last year and the crop exceeded expectations.” says Ganes.

This year, traders and market participants should watch the weather closely. The timing and intensity of the upcoming rains will be critical in shaping the market’s direction, as they will determine whether the current concerns about the crop are alleviated or exacerbated.

Seasonality Trends

Robusta coffee, known for its higher caffeine content and use in instant coffee and espresso blends, exhibits distinct seasonal price patterns. Several factors, including harvest cycles, weather conditions in key producing countries, and global demand dynamics influence seasonality in Robusta.

Typically, Robusta prices experience lower points during the main harvest seasons in major producing countries like Vietnam and Brazil. The influx of fresh supplies during these periods can lead to a temporary softening of prices. However, as the year progresses, particularly after the harvest is completed, prices often begin to rise. This increase is driven by concerns over the availability of future supplies, mainly if reports of adverse weather conditions affect the next crop.

Seasonal Chart by Moore Research.

In the first half of the year, Robusta prices usually stabilize or even decline as harvests in Vietnam, the world’s largest Robusta producer, flood the market. By mid-year, however, the market often shifts its focus to the upcoming crop season and potential risks. This is when prices start climbing, reflecting the market’s anticipation of possible supply disruptions due to weather or other factors.

The latter half of the year is often characterized by increased price volatility. This is particularly true if there are reports of droughts, excessive rainfall, or other climatic events that could impact the next harvest. As traders and investors react to these reports, prices can spike, particularly if there is uncertainty about the quality or quantity of the next crop.

Given the current conditions in Brazil and Vietnam, where weather has significantly shaped market expectations, we might see Robusta prices continue to exhibit this seasonal pattern. If the forecasts are true and the rain comes, it would again prove the above seasonal to be right.

Strategic Considerations: Actively monitoring Developments

For traders and investors, the key takeaway is the importance of closely monitoring weather developments in Brazil. The market is currently reacting to the challenges faced by coffee growers, but the situation could change quickly if the rains arrive as expected. As Ferraresso pointed out, “a yellow warning light is already on,” signaling the potential severity of the situation for the 2025 harvest.

Historically, we have seen these patterns before. While the extreme heat conditions are a concern, rain is forecasted in the areas that need it most. Photos have shown flowering covering hectares and hectares; we believe the rains will come in time. The cherries may be smaller, but quantity will more than likely make up for it.

Fundamentally, global production is on track to be greater than demand and should increase stockpiles. Reports of Brazil exporting 700,000 more bags in July vs a year ago, a 26% increase. Total exports for Brazil are up 46% YOY. Those reports are strong indicators that the 2024/25 season was not as bad as CONAB would like us to think. Rabobank is reporting 67.1m bags, still a substantial crop.

Given the current market dynamics, traders should remain vigilant. While opportunities exist in both Robusta and Arabica markets, the ongoing volatility and weather-related risks require careful consideration. Strategic positioning and risk management will be essential in navigating this environment.

Share This Story, Choose Your Platform!

Coffee Market Hits New Highs

Share This Story, Choose Your Platform

Coffee Market Update: Challenges in Brazil as Prices Hit New Highs

The coffee market is experiencing rising prices, particularly in the Robusta segment, as global supply concerns dominate discussions. Meanwhile, on-the-ground reports from Brazil provide a clearer picture of the struggles coffee growers face, which are likely to persist until the rains arrive.

Robusta Prices Increase Amid Supply Concerns

Robusta coffee prices have reached new highs, driven by ongoing concerns about global supply. These price movements reflect the strain on the market, particularly as major producers like Brazil and Vietnam navigate challenging conditions. The rise in Robusta prices underscores the impact of these supply issues, although the market remains cautious and is awaiting further developments.

Vietnamese Crop: Stable Outlook

In contrast to the situation in Brazil, Vietnam’s coffee crop outlook remains stable. “The Vietnamese crop is looking much better with excellent weather lately,” says Judy Ganes, President of J Ganes Consulting. The country, a significant producer of Robusta, has benefited from favorable weather, leading to expectations of a strong harvest this season. While this stability in Vietnam’s production offers some balance to the market, challenges remain in other key regions, particularly Brazil.

Brazilian Coffee Fields: Ongoing Struggles

Reports from Brazil indicate that coffee fields are under significant stress due to prolonged drought and high temperatures. These conditions have been particularly harsh in areas with higher yields, where the size of the beans is expected to be smaller than usual. The drought’s impact also extends into the 2025 season, especially in regions where production is typically strong.

According to Jonas Ferraresso, an agronomist on the ground in Brazil, “the climate issues have affected Arabica coffee plants in various ways depending on the time of year and the plant’s growth phase. For the 2024 crop, high temperatures during the development of the coffee fruits reduced the photosynthetic rate of the plants, resulting in smaller fruits that have already been harvested.” Ferraresso explains that “if this scenario continues until the end of September, we may have a problem with flowering, leading to fewer fruits per plant and a smaller harvest in 2025.”

The lack of recent rainfall has left many trees in a vulnerable state, with some crops already showing signs of damage that may not be recoverable. Ferraresso notes, “At the moment, the water deficit in coffee plantations is serious and premature. If the rains arrive in adequate volumes, at least 40 mm in the next 15 days, part of the damage can be recovered. However, a full harvest might only be possible in 2026.”

Market Focus: Eagerly Awaiting the Rain

The current focus in the coffee market is on the upcoming rainy season in Brazil. Historically, rain has played a significant role in determining the health and yield of coffee crops, and this year is no different. The last rainfall in many regions ended earlier than expected, and the trees are now waiting for the next round of rain, anticipated to start within the next few weeks. With below average rain during the early months of this year and elevated temperatures the markets run to new highs proves there is real concern over the health of the trees.

Until the rains arrive and relieve the fields, coffee futures prices will likely remain elevated. The market is closely watching weather forecasts, and any signs of delayed or insufficient rainfall could sustain or even drive prices higher. Last year, similar concerns about the crop last year persisted until the rains came.

“London is now reacting to all the talk of Brazil Conilon being hurt but I’m not entirely buying into it. Same was said last year and the crop exceeded expectations.” says Ganes.

This year, traders and market participants should watch the weather closely. The timing and intensity of the upcoming rains will be critical in shaping the market’s direction, as they will determine whether the current concerns about the crop are alleviated or exacerbated.

Seasonality Trends

Robusta coffee, known for its higher caffeine content and use in instant coffee and espresso blends, exhibits distinct seasonal price patterns. Several factors, including harvest cycles, weather conditions in key producing countries, and global demand dynamics influence seasonality in Robusta.

Typically, Robusta prices experience lower points during the main harvest seasons in major producing countries like Vietnam and Brazil. The influx of fresh supplies during these periods can lead to a temporary softening of prices. However, as the year progresses, particularly after the harvest is completed, prices often begin to rise. This increase is driven by concerns over the availability of future supplies, mainly if reports of adverse weather conditions affect the next crop.

Seasonal Chart by Moore Research.

In the first half of the year, Robusta prices usually stabilize or even decline as harvests in Vietnam, the world’s largest Robusta producer, flood the market. By mid-year, however, the market often shifts its focus to the upcoming crop season and potential risks. This is when prices start climbing, reflecting the market’s anticipation of possible supply disruptions due to weather or other factors.

The latter half of the year is often characterized by increased price volatility. This is particularly true if there are reports of droughts, excessive rainfall, or other climatic events that could impact the next harvest. As traders and investors react to these reports, prices can spike, particularly if there is uncertainty about the quality or quantity of the next crop.

Given the current conditions in Brazil and Vietnam, where weather has significantly shaped market expectations, we might see Robusta prices continue to exhibit this seasonal pattern. If the forecasts are true and the rain comes, it would again prove the above seasonal to be right.

Strategic Considerations: Actively monitoring Developments

For traders and investors, the key takeaway is the importance of closely monitoring weather developments in Brazil. The market is currently reacting to the challenges faced by coffee growers, but the situation could change quickly if the rains arrive as expected. As Ferraresso pointed out, “a yellow warning light is already on,” signaling the potential severity of the situation for the 2025 harvest.

Historically, we have seen these patterns before. While the extreme heat conditions are a concern, rain is forecasted in the areas that need it most. Photos have shown flowering covering hectares and hectares; we believe the rains will come in time. The cherries may be smaller, but quantity will more than likely make up for it.

Fundamentally, global production is on track to be greater than demand and should increase stockpiles. Reports of Brazil exporting 700,000 more bags in July vs a year ago, a 26% increase. Total exports for Brazil are up 46% YOY. Those reports are strong indicators that the 2024/25 season was not as bad as CONAB would like us to think. Rabobank is reporting 67.1m bags, still a substantial crop.

Given the current market dynamics, traders should remain vigilant. While opportunities exist in both Robusta and Arabica markets, the ongoing volatility and weather-related risks require careful consideration. Strategic positioning and risk management will be essential in navigating this environment.