Factors Impacting the Silver Investment Outlook for 2023

Share This Story, Choose Your Platform!

Long-time advocates for gold and silver ownership have been underwhelmed by the relatively modest increase in value over the past few years. The global economy has been impacted by ongoing crises, and one might have expected them to result in significantly higher prices. That has not yet been the case.

Advertisements for bullion predicted that precious metals would soar in value in the face of a global pandemic, civil unrest, runaway inflation, food shortages or world war. When an actual pandemic occurred, silver initially went on a decent rally, as did gold to a lesser extent, but prices peaked within six months.

As some of those other dominoes began to fall, gold and silver remained range bound. There are reasons for that lackluster performance, as well as reasons to believe that the silver investment outlook could change in 2023.

Gold and Silver Value Anchored Over the Past Decade

Recall that from 2012 to 2021 in the United States, the stock market returned 15 percent annually and inflation remained virtually nonexistent. As a result, there was not much demand for “store of value” investments. Additionally, the exciting new technology of cryptocurrency promised to replace fiat currency as a medium of exchange, as well as precious metals as the primary inflation hedge. Those factors were anchors holding down the price of gold and silver for a decade.

Last year, we saw the stock market crumble, crypto implode, inflation come roaring back to a 40-year high, the housing market peak and war erupt between two nations that are critical to the global supply of grain and fossil fuels. It was the third extraordinarily volatile year in a row, but the first wherein mainstream investors took a significant loss in their stock market portfolios, as some of the vaunted FAANG stocks were off by more than 50 percent.

People whose investments had been on autopilot for the previous decade suddenly became interested in finding safe havens for their wealth. It appeared, early on, that 2022 could have been the year for precious metals to finally break out to the upside. But one anchor remained attached: The decision by central banks to continue raising interest rates counteracted the strong organic fundamentals for silver.

How Long Can Fed’s Hawkish Interest Rate Policy Last?

After printing $13 trillion over two years, the Federal Reserve took aggressive action to combat inflation. During previous eras of hawkish interest rate policy, investors watched closely for any indication that the pace of rate hikes was about to slow down, considering that a buy signal for precious metals. At the beginning of 2023, the consensus opinion seemed to be that a change in interest rate policy was imminent and is not expected to be gradual.

Many were anticipating a hard landing for the economy leading to the Federal Reserve abruptly reversing course later this year, going from rate hike to rate cut overnight. If that were to happen, and the other bullish fundamentals remained in place, it would likely be the catalyst for silver to break out to multi year highs.

There is just one problem with that scenario. As often happens when there is a consensus opinion on the economy, the data has not cooperated with expectations. While recent economic reports suggest inflation has peaked, they also show low unemployment. There are many unknown variables, like the direction of the housing market, stock market and the effect of ballooning consumer debt.

There is not a clear path for the Federal Reserve right now, so we should be cautious with our forecast. However, even if we presume that central banks will remain hawkish this year there is a strong bullish case for silver.

Factors Impacting Silver Investment Outlook for 2023

As the world contemplates the likelihood of an economic downturn this year, investors want to put their capital into something tangible that still has significant upside potential. Silver’s dual nature as both an industrial and precious metal creates unique pricing dynamics. A flight to quality provides a boost to demand for silver as a store of value, while a slowdown of economic activity softens demand from industry and consumers.

Those opposing forces help shape the price of silver, but a shift has been taking place in recent years. In addition to the Federal Reserve interest rate policy, some of the other current factors impacting the silver investment outlook for 2023 include the following.

Clean Energy and Government Subsidies

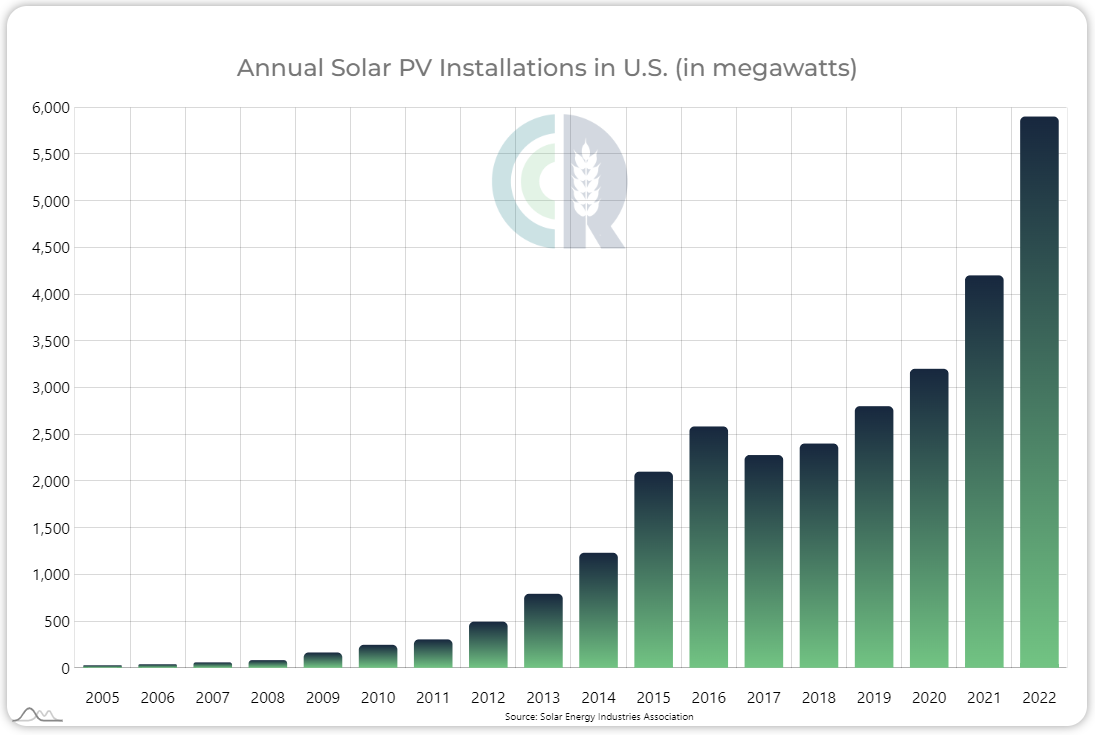

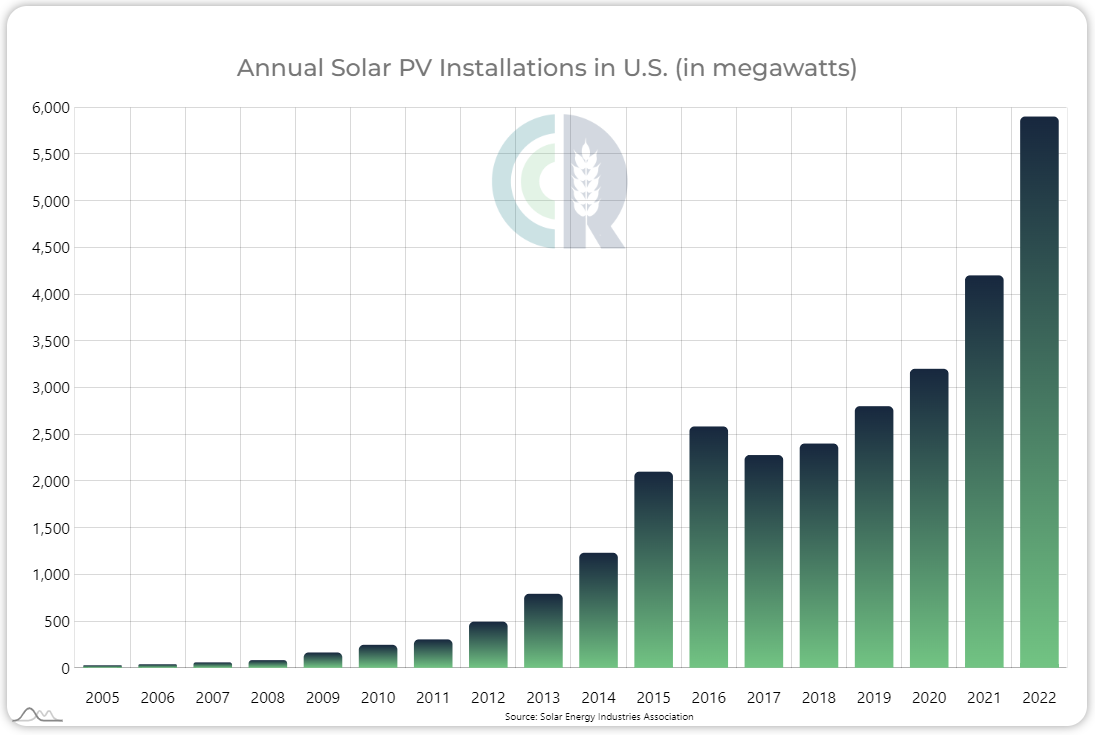

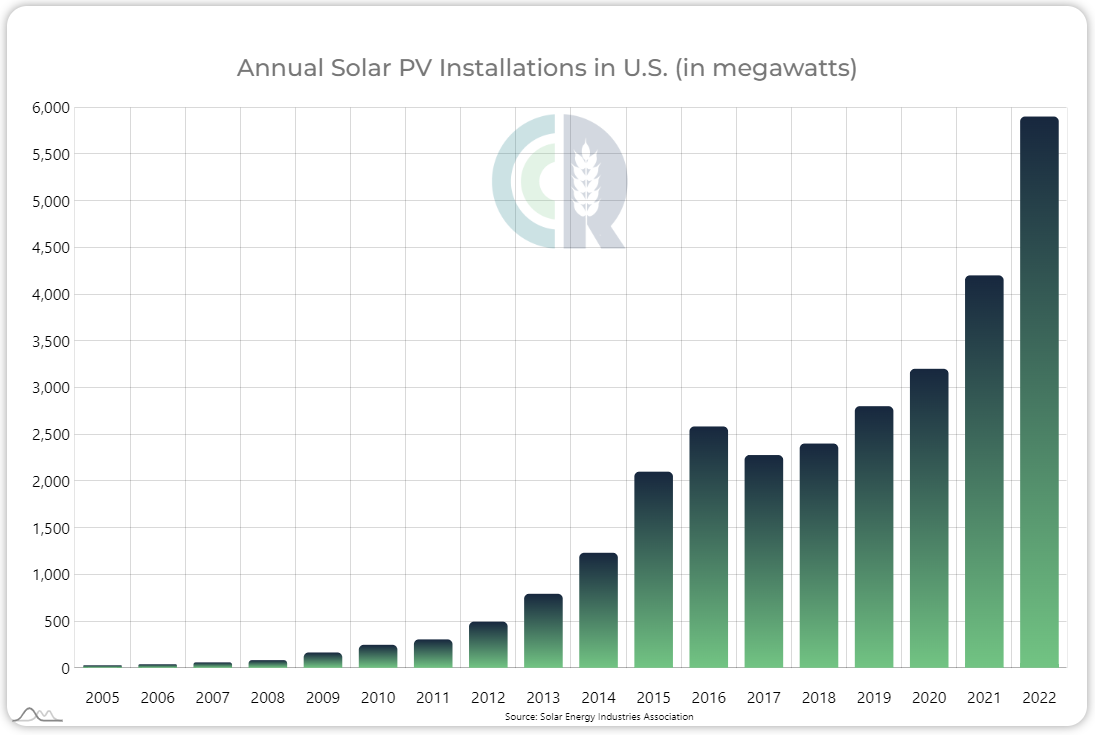

Much of the industrial demand for silver now comes from clean energy, which is subsidized by governments and thus not as heavily impacted by the business cycle. A prolonged recession can spur deficit spending on infrastructure which increases demand for solar panels and batteries while simultaneously adding to inflationary pressure. Much of the $1.2 trillion infrastructure spending approved in 2021 has yet to be spent.

COMEX Vault Inventory

A key data point to keep an eye on is the inventory of registered silver in the COMEX vaults, which as of December was down 60 percent year over year. Stockpiles were at a historic high just a few years ago, but consistent outflows since early 2021 continue to deplete them. While it is unlikely the exchange would fail to meet its obligations, the mere mention of that possibility has caused extraordinary price moves in the past (see 1979-80 for an example). I don’t envision that type of panic, but the outflows are an indication that investors have a strong desire to maintain possession of physical assets.

Retail Demand for Silver

Gold has seen a similar trend to silver, but, as the price of both metals continues to increase, some bullion hoarders, coin collectors, and jewelry shoppers will be priced out of gold and turn to silver.

If one wants to spend $200 on a gift, they can choose between a 10-ounce silver bar that feels substantial in their hand, or a 1/10th of an ounce spec of gold dust. This point may seem trivial to anyone managing a multimillion-dollar portfolio, but with India surpassing China in population and their economy continuing to industrialize, retail demand for jewelry and ornaments will have a significant impact on global demand.

India has a cultural tradition of giving lavish gifts of jewelry for holidays and special occasions. The price of gold even has a correlation to rainfall on the subcontinent – when Indian farmers have a good year, they spend a lot on gold. Wedding gifts are the primary driver of jewelry demand in India, and that is an area projected for major growth. India has a population of 1.4 billion people, and more than 40 percent of their population is under 25. On average, Indian women marry at the age of 22. This means there will be an estimated 12 million weddings in India this year, and that figure will continue growing.

There are a multitude of reasons to own silver right now. Bullion is best suited for a long term buy-and-hold investment, but silver futures or ETF purchases can be strategic and opportunistic. An investor holding a bullish long-term outlook based on strong fundamentals should consider technical indicators and the economic calendar when choosing their entry points. Short of that, a simple dollar cost averaging technique can work just fine. We are looking for opportunities to get long in the low $20s, with an expectation of seeing futures top $30 before the end of the year.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]Share This Story, Choose Your Platform!

Factors Impacting the Silver Investment Outlook for 2023

Share This Story, Choose Your Platform

Long-time advocates for gold and silver ownership have been underwhelmed by the relatively modest increase in value over the past few years. The global economy has been impacted by ongoing crises, and one might have expected them to result in significantly higher prices. That has not yet been the case.

Advertisements for bullion predicted that precious metals would soar in value in the face of a global pandemic, civil unrest, runaway inflation, food shortages or world war. When an actual pandemic occurred, silver initially went on a decent rally, as did gold to a lesser extent, but prices peaked within six months.

As some of those other dominoes began to fall, gold and silver remained range bound. There are reasons for that lackluster performance, as well as reasons to believe that the silver investment outlook could change in 2023.

Gold and Silver Value Anchored Over the Past Decade

Recall that from 2012 to 2021 in the United States, the stock market returned 15 percent annually and inflation remained virtually nonexistent. As a result, there was not much demand for “store of value” investments. Additionally, the exciting new technology of cryptocurrency promised to replace fiat currency as a medium of exchange, as well as precious metals as the primary inflation hedge. Those factors were anchors holding down the price of gold and silver for a decade.

Last year, we saw the stock market crumble, crypto implode, inflation come roaring back to a 40-year high, the housing market peak and war erupt between two nations that are critical to the global supply of grain and fossil fuels. It was the third extraordinarily volatile year in a row, but the first wherein mainstream investors took a significant loss in their stock market portfolios, as some of the vaunted FAANG stocks were off by more than 50 percent.

People whose investments had been on autopilot for the previous decade suddenly became interested in finding safe havens for their wealth. It appeared, early on, that 2022 could have been the year for precious metals to finally break out to the upside. But one anchor remained attached: The decision by central banks to continue raising interest rates counteracted the strong organic fundamentals for silver.

How Long Can Fed’s Hawkish Interest Rate Policy Last?

After printing $13 trillion over two years, the Federal Reserve took aggressive action to combat inflation. During previous eras of hawkish interest rate policy, investors watched closely for any indication that the pace of rate hikes was about to slow down, considering that a buy signal for precious metals. At the beginning of 2023, the consensus opinion seemed to be that a change in interest rate policy was imminent and is not expected to be gradual.

Many were anticipating a hard landing for the economy leading to the Federal Reserve abruptly reversing course later this year, going from rate hike to rate cut overnight. If that were to happen, and the other bullish fundamentals remained in place, it would likely be the catalyst for silver to break out to multi year highs.

There is just one problem with that scenario. As often happens when there is a consensus opinion on the economy, the data has not cooperated with expectations. While recent economic reports suggest inflation has peaked, they also show low unemployment. There are many unknown variables, like the direction of the housing market, stock market and the effect of ballooning consumer debt.

There is not a clear path for the Federal Reserve right now, so we should be cautious with our forecast. However, even if we presume that central banks will remain hawkish this year there is a strong bullish case for silver.

Factors Impacting Silver Investment Outlook for 2023

As the world contemplates the likelihood of an economic downturn this year, investors want to put their capital into something tangible that still has significant upside potential. Silver’s dual nature as both an industrial and precious metal creates unique pricing dynamics. A flight to quality provides a boost to demand for silver as a store of value, while a slowdown of economic activity softens demand from industry and consumers.

Those opposing forces help shape the price of silver, but a shift has been taking place in recent years. In addition to the Federal Reserve interest rate policy, some of the other current factors impacting the silver investment outlook for 2023 include the following.

Clean Energy and Government Subsidies

Much of the industrial demand for silver now comes from clean energy, which is subsidized by governments and thus not as heavily impacted by the business cycle. A prolonged recession can spur deficit spending on infrastructure which increases demand for solar panels and batteries while simultaneously adding to inflationary pressure. Much of the $1.2 trillion infrastructure spending approved in 2021 has yet to be spent.

COMEX Vault Inventory

A key data point to keep an eye on is the inventory of registered silver in the COMEX vaults, which as of December was down 60 percent year over year. Stockpiles were at a historic high just a few years ago, but consistent outflows since early 2021 continue to deplete them. While it is unlikely the exchange would fail to meet its obligations, the mere mention of that possibility has caused extraordinary price moves in the past (see 1979-80 for an example). I don’t envision that type of panic, but the outflows are an indication that investors have a strong desire to maintain possession of physical assets.

Retail Demand for Silver

Gold has seen a similar trend to silver, but, as the price of both metals continues to increase, some bullion hoarders, coin collectors, and jewelry shoppers will be priced out of gold and turn to silver.

If one wants to spend $200 on a gift, they can choose between a 10-ounce silver bar that feels substantial in their hand, or a 1/10th of an ounce spec of gold dust. This point may seem trivial to anyone managing a multimillion-dollar portfolio, but with India surpassing China in population and their economy continuing to industrialize, retail demand for jewelry and ornaments will have a significant impact on global demand.

India has a cultural tradition of giving lavish gifts of jewelry for holidays and special occasions. The price of gold even has a correlation to rainfall on the subcontinent – when Indian farmers have a good year, they spend a lot on gold. Wedding gifts are the primary driver of jewelry demand in India, and that is an area projected for major growth. India has a population of 1.4 billion people, and more than 40 percent of their population is under 25. On average, Indian women marry at the age of 22. This means there will be an estimated 12 million weddings in India this year, and that figure will continue growing.

There are a multitude of reasons to own silver right now. Bullion is best suited for a long term buy-and-hold investment, but silver futures or ETF purchases can be strategic and opportunistic. An investor holding a bullish long-term outlook based on strong fundamentals should consider technical indicators and the economic calendar when choosing their entry points. Short of that, a simple dollar cost averaging technique can work just fine. We are looking for opportunities to get long in the low $20s, with an expectation of seeing futures top $30 before the end of the year.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]Share This Story, Choose Your Platform!

Factors Impacting the Silver Investment Outlook for 2023

Share This Story, Choose Your Platform

Long-time advocates for gold and silver ownership have been underwhelmed by the relatively modest increase in value over the past few years. The global economy has been impacted by ongoing crises, and one might have expected them to result in significantly higher prices. That has not yet been the case.

Advertisements for bullion predicted that precious metals would soar in value in the face of a global pandemic, civil unrest, runaway inflation, food shortages or world war. When an actual pandemic occurred, silver initially went on a decent rally, as did gold to a lesser extent, but prices peaked within six months.

As some of those other dominoes began to fall, gold and silver remained range bound. There are reasons for that lackluster performance, as well as reasons to believe that the silver investment outlook could change in 2023.

Gold and Silver Value Anchored Over the Past Decade

Recall that from 2012 to 2021 in the United States, the stock market returned 15 percent annually and inflation remained virtually nonexistent. As a result, there was not much demand for “store of value” investments. Additionally, the exciting new technology of cryptocurrency promised to replace fiat currency as a medium of exchange, as well as precious metals as the primary inflation hedge. Those factors were anchors holding down the price of gold and silver for a decade.

Last year, we saw the stock market crumble, crypto implode, inflation come roaring back to a 40-year high, the housing market peak and war erupt between two nations that are critical to the global supply of grain and fossil fuels. It was the third extraordinarily volatile year in a row, but the first wherein mainstream investors took a significant loss in their stock market portfolios, as some of the vaunted FAANG stocks were off by more than 50 percent.

People whose investments had been on autopilot for the previous decade suddenly became interested in finding safe havens for their wealth. It appeared, early on, that 2022 could have been the year for precious metals to finally break out to the upside. But one anchor remained attached: The decision by central banks to continue raising interest rates counteracted the strong organic fundamentals for silver.

How Long Can Fed’s Hawkish Interest Rate Policy Last?

After printing $13 trillion over two years, the Federal Reserve took aggressive action to combat inflation. During previous eras of hawkish interest rate policy, investors watched closely for any indication that the pace of rate hikes was about to slow down, considering that a buy signal for precious metals. At the beginning of 2023, the consensus opinion seemed to be that a change in interest rate policy was imminent and is not expected to be gradual.

Many were anticipating a hard landing for the economy leading to the Federal Reserve abruptly reversing course later this year, going from rate hike to rate cut overnight. If that were to happen, and the other bullish fundamentals remained in place, it would likely be the catalyst for silver to break out to multi year highs.

There is just one problem with that scenario. As often happens when there is a consensus opinion on the economy, the data has not cooperated with expectations. While recent economic reports suggest inflation has peaked, they also show low unemployment. There are many unknown variables, like the direction of the housing market, stock market and the effect of ballooning consumer debt.

There is not a clear path for the Federal Reserve right now, so we should be cautious with our forecast. However, even if we presume that central banks will remain hawkish this year there is a strong bullish case for silver.

Factors Impacting Silver Investment Outlook for 2023

As the world contemplates the likelihood of an economic downturn this year, investors want to put their capital into something tangible that still has significant upside potential. Silver’s dual nature as both an industrial and precious metal creates unique pricing dynamics. A flight to quality provides a boost to demand for silver as a store of value, while a slowdown of economic activity softens demand from industry and consumers.

Those opposing forces help shape the price of silver, but a shift has been taking place in recent years. In addition to the Federal Reserve interest rate policy, some of the other current factors impacting the silver investment outlook for 2023 include the following.

Clean Energy and Government Subsidies

Much of the industrial demand for silver now comes from clean energy, which is subsidized by governments and thus not as heavily impacted by the business cycle. A prolonged recession can spur deficit spending on infrastructure which increases demand for solar panels and batteries while simultaneously adding to inflationary pressure. Much of the $1.2 trillion infrastructure spending approved in 2021 has yet to be spent.

COMEX Vault Inventory

A key data point to keep an eye on is the inventory of registered silver in the COMEX vaults, which as of December was down 60 percent year over year. Stockpiles were at a historic high just a few years ago, but consistent outflows since early 2021 continue to deplete them. While it is unlikely the exchange would fail to meet its obligations, the mere mention of that possibility has caused extraordinary price moves in the past (see 1979-80 for an example). I don’t envision that type of panic, but the outflows are an indication that investors have a strong desire to maintain possession of physical assets.

Retail Demand for Silver

Gold has seen a similar trend to silver, but, as the price of both metals continues to increase, some bullion hoarders, coin collectors, and jewelry shoppers will be priced out of gold and turn to silver.

If one wants to spend $200 on a gift, they can choose between a 10-ounce silver bar that feels substantial in their hand, or a 1/10th of an ounce spec of gold dust. This point may seem trivial to anyone managing a multimillion-dollar portfolio, but with India surpassing China in population and their economy continuing to industrialize, retail demand for jewelry and ornaments will have a significant impact on global demand.

India has a cultural tradition of giving lavish gifts of jewelry for holidays and special occasions. The price of gold even has a correlation to rainfall on the subcontinent – when Indian farmers have a good year, they spend a lot on gold. Wedding gifts are the primary driver of jewelry demand in India, and that is an area projected for major growth. India has a population of 1.4 billion people, and more than 40 percent of their population is under 25. On average, Indian women marry at the age of 22. This means there will be an estimated 12 million weddings in India this year, and that figure will continue growing.

There are a multitude of reasons to own silver right now. Bullion is best suited for a long term buy-and-hold investment, but silver futures or ETF purchases can be strategic and opportunistic. An investor holding a bullish long-term outlook based on strong fundamentals should consider technical indicators and the economic calendar when choosing their entry points. Short of that, a simple dollar cost averaging technique can work just fine. We are looking for opportunities to get long in the low $20s, with an expectation of seeing futures top $30 before the end of the year.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]