Ukraine, Brazilian Exports Could Undermine U.S. Corn Prices This Summer

Share This Story, Choose Your Platform!

As farmers in the United States get ready to begin the 2023 planting season, the balance of power in corn prices may be shifting towards bears.

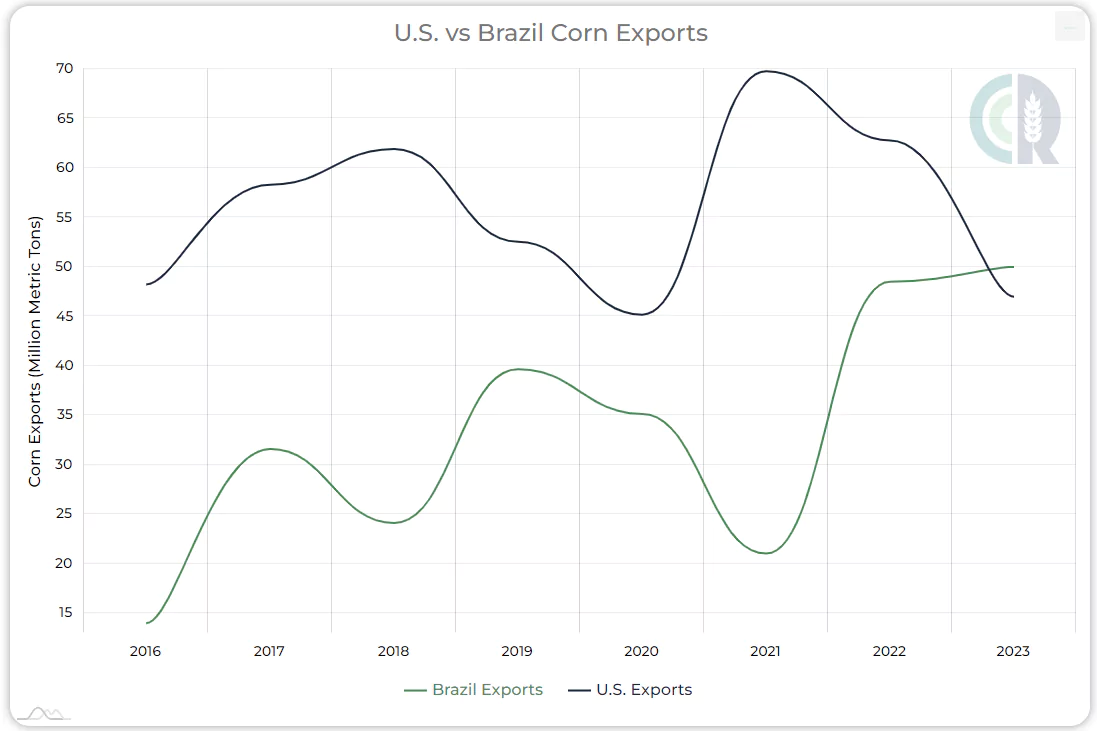

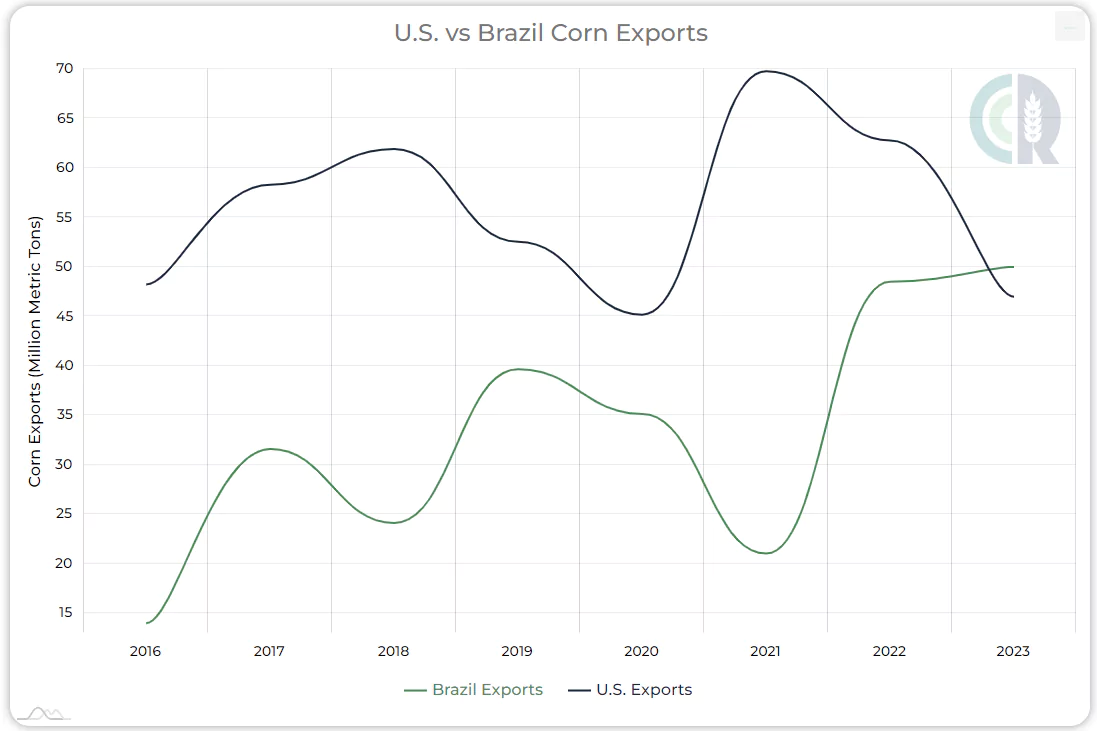

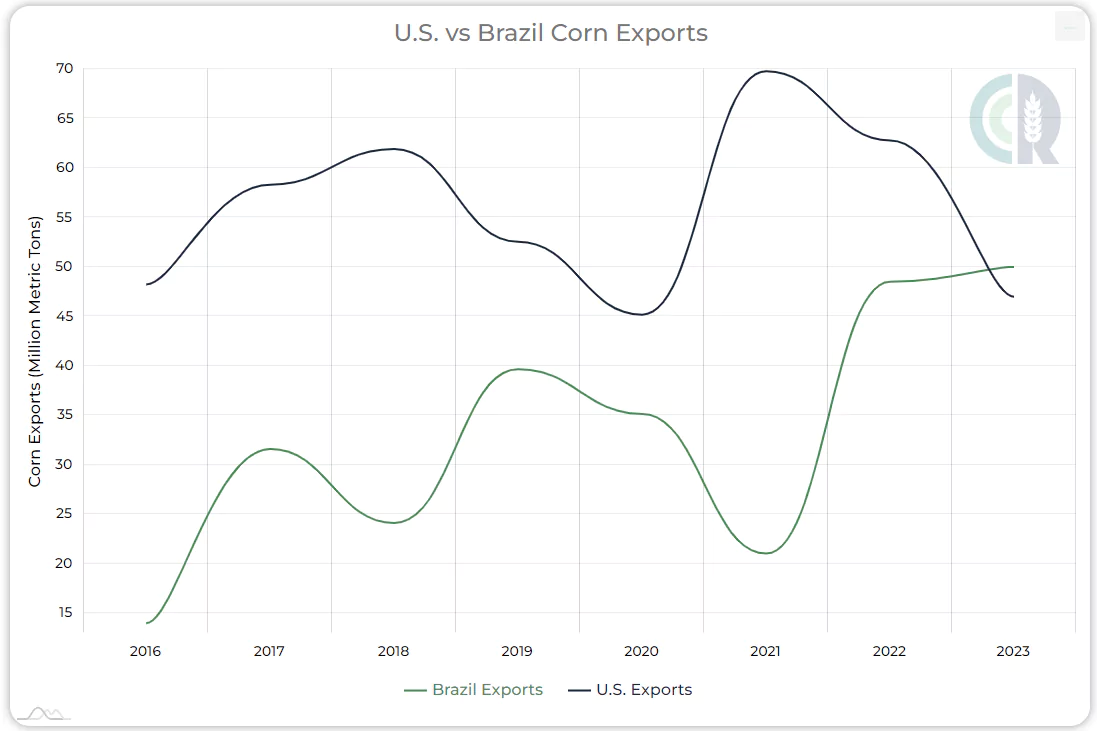

For evidence of this, traders should first consider Brazil. While Brazil long ago surpassed the U.S. as an exporter of both soybeans and orange juice, U.S. corn remained a sacred cow.

No longer.

Brazil has become a clear winner in the corn export market, taking advantage of high U.S. corn prices by signing their own agreements with China. Brazil will surpass the U.S. this year as the global leader in corn exports. The U.S. is now projected to export 46.99 million metric tons (mmt) of corn this crop year while Brazil, as of the USDA March report, will export 50 mmt. Brazil has been able to increase its overall production from 87 mmt in the 2020/2021 marketing year to a projected 125 mmt in the 2022/2023 marketing year.

The U.S. accounted for as much as 70% of the total corn imported by China. The U.S. share will likely begin to drop this year as China makes their move to Brazil for cheaper corn. China has officially permitted 100 more Brazilian facilities to export corn to China.

Ukraine Corn Exports Continue – For Now – With Black Sea Agreement

Meanwhile, if all goes well, pent up Ukrainian supplies should continue to flow onto world markets.

Signed in July 2022, the Black Sea agreement enabled the safe passage of Ukraine grain exports through three ports during the war. Surprisingly, Ukraine has been able to export much more corn than originally anticipated. In December 2022, Ukraine was able to export 3 million metric tons of corn, the largest since the start of the war. Ukraine has also accumulated corn stocks almost four times the average for this time of year. There should be no shortage of available corn to export in Ukraine.

The Black Sea agreement was scheduled to end on March 18, 2023. However, that deal has been extended. As of this writing, the length of time it was extended is unclear. Ukraine is saying the extension is for 120 days and Russia is adamant they only agreed to 60 days. This will be a big story to follow as more than 25 million metric tons of grain has been exported through this agreement, helping to ease food prices around the world.

U.S. Farmers Prepare to Plant Corn Crop

In the U.S., corn farmers eagerly await the last frost of spring to move out. Corn has made a stronger case over the last year to U.S. farmers compared with soybeans. According to the USDA Prospective Planting report on March 31, corn acreage in the U.S. will increase 3.42 million acres over last year. Soybeans on the other hand will have a small increase to 87.5 million acres. Corn is expected to be at or above last years planted acres in 40 of 48 estimating states. U.S. 22/23 ending stocks will drop by approximately 900,000 metric tons however Brazil will more than make up for that increasing their ending stocks more than double from the 21/22 year up 3.2 million metric tons.

Seasonal tendencies favor a drop in corn prices once the new U.S. corn crop is “in the ground.” This can often occur anywhere from late May to late June. With Brazilian and Ukrainian supply providing a cushion for any U.S. shortfalls, any planting rallies this spring could be short selling opportunities for bearish traders.

We’ll be monitoring U.S. planting progress and global supply changes in the coming weeks and will update as needed.

Share This Story, Choose Your Platform!

Ukraine, Brazilian Exports Could Undermine U.S. Corn Prices This Summer

Share This Story, Choose Your Platform

As farmers in the United States get ready to begin the 2023 planting season, the balance of power in corn prices may be shifting towards bears.

For evidence of this, traders should first consider Brazil. While Brazil long ago surpassed the U.S. as an exporter of both soybeans and orange juice, U.S. corn remained a sacred cow.

No longer.

Brazil has become a clear winner in the corn export market, taking advantage of high U.S. corn prices by signing their own agreements with China. Brazil will surpass the U.S. this year as the global leader in corn exports. The U.S. is now projected to export 46.99 million metric tons (mmt) of corn this crop year while Brazil, as of the USDA March report, will export 50 mmt. Brazil has been able to increase its overall production from 87 mmt in the 2020/2021 marketing year to a projected 125 mmt in the 2022/2023 marketing year.

The U.S. accounted for as much as 70% of the total corn imported by China. The U.S. share will likely begin to drop this year as China makes their move to Brazil for cheaper corn. China has officially permitted 100 more Brazilian facilities to export corn to China.

Ukraine Corn Exports Continue – For Now – With Black Sea Agreement

Meanwhile, if all goes well, pent up Ukrainian supplies should continue to flow onto world markets.

Signed in July 2022, the Black Sea agreement enabled the safe passage of Ukraine grain exports through three ports during the war. Surprisingly, Ukraine has been able to export much more corn than originally anticipated. In December 2022, Ukraine was able to export 3 million metric tons of corn, the largest since the start of the war. Ukraine has also accumulated corn stocks almost four times the average for this time of year. There should be no shortage of available corn to export in Ukraine.

The Black Sea agreement was scheduled to end on March 18, 2023. However, that deal has been extended. As of this writing, the length of time it was extended is unclear. Ukraine is saying the extension is for 120 days and Russia is adamant they only agreed to 60 days. This will be a big story to follow as more than 25 million metric tons of grain has been exported through this agreement, helping to ease food prices around the world.

U.S. Farmers Prepare to Plant Corn Crop

In the U.S., corn farmers eagerly await the last frost of spring to move out. Corn has made a stronger case over the last year to U.S. farmers compared with soybeans. According to the USDA Prospective Planting report on March 31, corn acreage in the U.S. will increase 3.42 million acres over last year. Soybeans on the other hand will have a small increase to 87.5 million acres. Corn is expected to be at or above last years planted acres in 40 of 48 estimating states. U.S. 22/23 ending stocks will drop by approximately 900,000 metric tons however Brazil will more than make up for that increasing their ending stocks more than double from the 21/22 year up 3.2 million metric tons.

Seasonal tendencies favor a drop in corn prices once the new U.S. corn crop is “in the ground.” This can often occur anywhere from late May to late June. With Brazilian and Ukrainian supply providing a cushion for any U.S. shortfalls, any planting rallies this spring could be short selling opportunities for bearish traders.

We’ll be monitoring U.S. planting progress and global supply changes in the coming weeks and will update as needed.

Share This Story, Choose Your Platform!

Ukraine, Brazilian Exports Could Undermine U.S. Corn Prices This Summer

Share This Story, Choose Your Platform

As farmers in the United States get ready to begin the 2023 planting season, the balance of power in corn prices may be shifting towards bears.

For evidence of this, traders should first consider Brazil. While Brazil long ago surpassed the U.S. as an exporter of both soybeans and orange juice, U.S. corn remained a sacred cow.

No longer.

Brazil has become a clear winner in the corn export market, taking advantage of high U.S. corn prices by signing their own agreements with China. Brazil will surpass the U.S. this year as the global leader in corn exports. The U.S. is now projected to export 46.99 million metric tons (mmt) of corn this crop year while Brazil, as of the USDA March report, will export 50 mmt. Brazil has been able to increase its overall production from 87 mmt in the 2020/2021 marketing year to a projected 125 mmt in the 2022/2023 marketing year.

The U.S. accounted for as much as 70% of the total corn imported by China. The U.S. share will likely begin to drop this year as China makes their move to Brazil for cheaper corn. China has officially permitted 100 more Brazilian facilities to export corn to China.

Ukraine Corn Exports Continue – For Now – With Black Sea Agreement

Meanwhile, if all goes well, pent up Ukrainian supplies should continue to flow onto world markets.

Signed in July 2022, the Black Sea agreement enabled the safe passage of Ukraine grain exports through three ports during the war. Surprisingly, Ukraine has been able to export much more corn than originally anticipated. In December 2022, Ukraine was able to export 3 million metric tons of corn, the largest since the start of the war. Ukraine has also accumulated corn stocks almost four times the average for this time of year. There should be no shortage of available corn to export in Ukraine.

The Black Sea agreement was scheduled to end on March 18, 2023. However, that deal has been extended. As of this writing, the length of time it was extended is unclear. Ukraine is saying the extension is for 120 days and Russia is adamant they only agreed to 60 days. This will be a big story to follow as more than 25 million metric tons of grain has been exported through this agreement, helping to ease food prices around the world.

U.S. Farmers Prepare to Plant Corn Crop

In the U.S., corn farmers eagerly await the last frost of spring to move out. Corn has made a stronger case over the last year to U.S. farmers compared with soybeans. According to the USDA Prospective Planting report on March 31, corn acreage in the U.S. will increase 3.42 million acres over last year. Soybeans on the other hand will have a small increase to 87.5 million acres. Corn is expected to be at or above last years planted acres in 40 of 48 estimating states. U.S. 22/23 ending stocks will drop by approximately 900,000 metric tons however Brazil will more than make up for that increasing their ending stocks more than double from the 21/22 year up 3.2 million metric tons.

Seasonal tendencies favor a drop in corn prices once the new U.S. corn crop is “in the ground.” This can often occur anywhere from late May to late June. With Brazilian and Ukrainian supply providing a cushion for any U.S. shortfalls, any planting rallies this spring could be short selling opportunities for bearish traders.

We’ll be monitoring U.S. planting progress and global supply changes in the coming weeks and will update as needed.