Supply Glut Dampens Prospects For NYMEX Natural Gas

Share This Story, Choose Your Platform!

A Challenging Outlook for Nymex Natural Gas

Despite the recent surge to over $3 in July Nymex natural gas prices driven by warmer temperature forecasts, several factors suggest a challenging outlook.

Uncertain Weather Forecasts

While predictions of warmer temperatures for June have driven natural gas prices higher, weather forecasts are notoriously volatile. The National Weather Service’s projection of above-average temperatures might not fully materialize, potentially reducing the expected boost in electricity demand for air conditioning.

Energy Requirements: Heating vs. Cooling

The amount of natural gas needed for heating typically exceeds that for cooling due to greater temperature differences. For instance, heating a home in winter requires more energy compared to cooling it in summer. Efficiency of heating systems (90-98%) versus cooling systems (SEER of 14-20), climate conditions, and building insulation also have influence. In colder climates, heating can use 50-70% of annual energy consumption, while cooling only 10-20%.

- Heating Load: Larger temperature difference and longer duration in cold climates can lead to a higher cumulative energy requirement.

- Cooling Load: Smaller temperature difference and generally shorter duration can lead to a lower cumulative energy requirement.

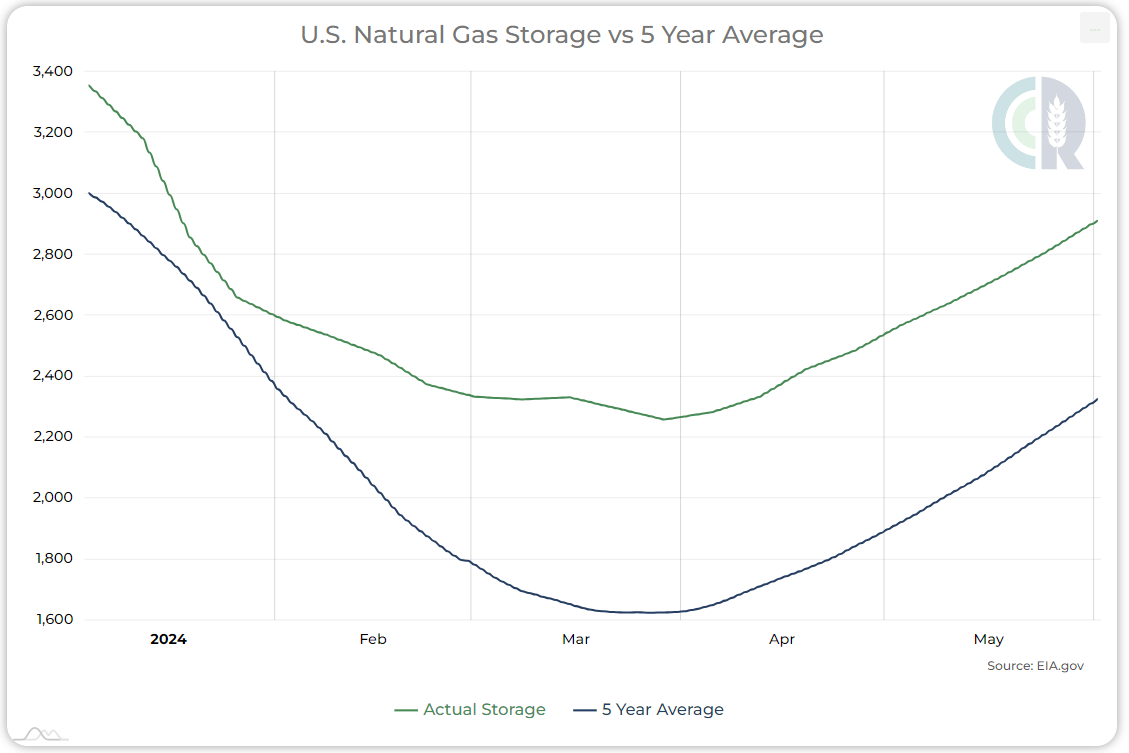

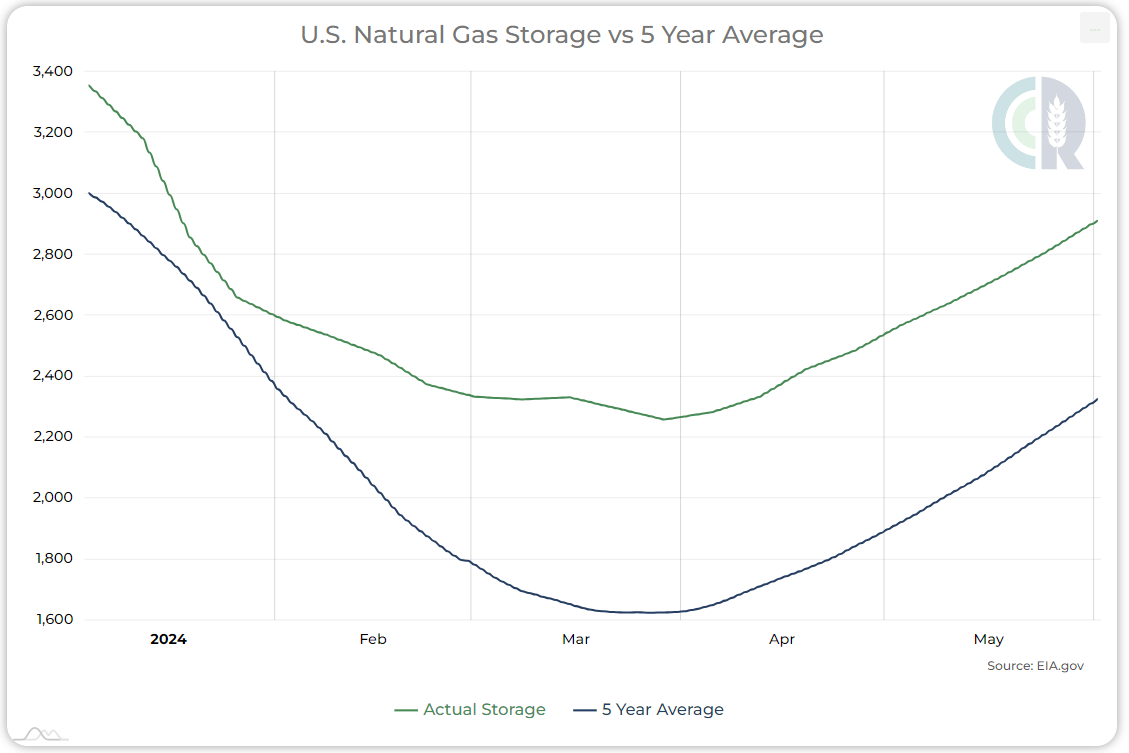

Increasing Inventories

A significant bearish signal is the rise in natural gas inventories. According to the EIA, inventories for the week ending June 7, increased by 74 Bcf. Total storage reached 2,974 Bcf, up 13.9% from a year ago and 23.9% above the 5-year average. This surplus suggests ample supply, which could put downward pressure on prices.

Declining Domestic Demand

Despite a potential short-term rise in electricity usage, in May the EIA forecasted an overall lower-48 state gas demand decrease for May year-over-year. And a flat demand for the rest of the year.

High European Storage Levels

According to Celsius Energy, European gas storage is 71% full, well above the 5-year average of 58%. These high storage levels indicate that Europe is adequately supplied, reducing its need for additional US imports and contributing to a global oversupply.

Decreased Drilling Activity

The number of active US natural gas drilling rigs has dropped to 98 rigs as of June 4th, down 27.4% year-on-year. This reduction in drilling activity reflects a lack of confidence among producers in sustained high prices, suggesting they anticipate a price decline. For the first time since January 2022, the total rig count is below 600, currently standing at 594.

Impact on Energy Prices

Natural gas prices often influence the broader energy market, affecting electricity prices, heating costs, and industrial production. A bearish outlook on natural gas can signal potential shifts in energy prices, impacting both consumers and businesses.

Conclusion

While current weather-driven price increases might appear bullish, the broader supply-demand dynamics indicate a more challenging outlook for natural gas. Rising inventories, declining to flat domestic demand, reduced export activity, high European storage levels, and decreased drilling activity all point to the likelihood that the recent price surge may be temporary. Investors should be cautious and consider these factors when evaluating the future direction of natural gas prices.

Share This Story, Choose Your Platform!

Supply Glut Dampens Prospects For NYMEX Natural Gas

Share This Story, Choose Your Platform

A Challenging Outlook for Nymex Natural Gas

Despite the recent surge to over $3 in July Nymex natural gas prices driven by warmer temperature forecasts, several factors suggest a challenging outlook.

Uncertain Weather Forecasts

While predictions of warmer temperatures for June have driven natural gas prices higher, weather forecasts are notoriously volatile. The National Weather Service’s projection of above-average temperatures might not fully materialize, potentially reducing the expected boost in electricity demand for air conditioning.

Energy Requirements: Heating vs. Cooling

The amount of natural gas needed for heating typically exceeds that for cooling due to greater temperature differences. For instance, heating a home in winter requires more energy compared to cooling it in summer. Efficiency of heating systems (90-98%) versus cooling systems (SEER of 14-20), climate conditions, and building insulation also have influence. In colder climates, heating can use 50-70% of annual energy consumption, while cooling only 10-20%.

- Heating Load: Larger temperature difference and longer duration in cold climates can lead to a higher cumulative energy requirement.

- Cooling Load: Smaller temperature difference and generally shorter duration can lead to a lower cumulative energy requirement.

Increasing Inventories

A significant bearish signal is the rise in natural gas inventories. According to the EIA, inventories for the week ending June 7, increased by 74 Bcf. Total storage reached 2,974 Bcf, up 13.9% from a year ago and 23.9% above the 5-year average. This surplus suggests ample supply, which could put downward pressure on prices.

Declining Domestic Demand

Despite a potential short-term rise in electricity usage, in May the EIA forecasted an overall lower-48 state gas demand decrease for May year-over-year. And a flat demand for the rest of the year.

High European Storage Levels

According to Celsius Energy, European gas storage is 71% full, well above the 5-year average of 58%. These high storage levels indicate that Europe is adequately supplied, reducing its need for additional US imports and contributing to a global oversupply.

Decreased Drilling Activity

The number of active US natural gas drilling rigs has dropped to 98 rigs as of June 4th, down 27.4% year-on-year. This reduction in drilling activity reflects a lack of confidence among producers in sustained high prices, suggesting they anticipate a price decline. For the first time since January 2022, the total rig count is below 600, currently standing at 594.

Impact on Energy Prices

Natural gas prices often influence the broader energy market, affecting electricity prices, heating costs, and industrial production. A bearish outlook on natural gas can signal potential shifts in energy prices, impacting both consumers and businesses.

Conclusion

While current weather-driven price increases might appear bullish, the broader supply-demand dynamics indicate a more challenging outlook for natural gas. Rising inventories, declining to flat domestic demand, reduced export activity, high European storage levels, and decreased drilling activity all point to the likelihood that the recent price surge may be temporary. Investors should be cautious and consider these factors when evaluating the future direction of natural gas prices.