Time May Be Running Out for Patient Gold Bulls

Share This Story, Choose Your Platform!

Many long-term gold bulls, us included, have been biding their time over the past few months, waiting for a significant pullback as an opportunity to bolster their positions after the precious metal reached near-record prices earlier this year. A breakout to the upside into new territory seems highly probable. It’s ultimately a question of when such a move might occur.

Traders are apprehensive about pulling the trigger to buy at these levels because they could end up with egg on their face in the event that continued interest rate hikes cause the price to fall back below $1,800 later this year, but the opposite scenario poses a greater asymmetric long-term risk in our opinion.

Given the current macroeconomic and geopolitical circumstances, continuing to wait patiently for a buying opportunity no longer seems like a prudent strategy. Everyone likes to get in at the bottom, but seasoned investors know that it is nearly impossible to achieve perfect timing. There are too many uncontrollable and unpredictable factors at play. With the price of gold currently below $2,000 per ounce, ask yourself which price we are more likely to see next, $1,500 or $2,500?

Near-term Upside Risk Factors for the Price of Gold

A shift from hawkish to dovish Federal Reserve policy, an errant missile intended for Ukraine but landing in a NATO country, a military coup, nuclear strike, rapid devaluation of the United States dollar, upcoming election chaos, civil unrest in America and abroad, reconfiguring of the global trade order, and several other reasonably likely scenarios could be the catalyst that sends gold to the next level. Those threats are hanging over this market like a chandelier of Damoclesian swords. If one of them were to fall, the others may follow, which would cause the price of gold to ascend well beyond the record high of $2,075 set in August 2020.

At that point, technical traders would feel foolish for having tried to squeeze a few more dollars before buying. If one enters a limit order to buy gold futures a few percentage points below the current price, there is a good chance that it will get filled before the end of the year. However, if the price of gold gaps up without warning, which is certainly plausible, they will have missed an opportunity that may never come around again.

Admittedly, we do not have a definitive answer to the question of when this might occur. It could be today, next month, next year, or a few years down the road depending on how several key issues play out.

The Long-Term Fundamental Case for Owning Gold

After three decades with essentially zero inflation, which could more accurately be described as hidden inflation, we witnessed in recent years how quickly it can come roaring back. Most analysts in the market are too young to recall the inflationary period of the 1970s and 1980s, and so they believed the “transitory” narrative of the past two years.

With the Treasury Department and Federal Reserve’s willingness to create trillions of dollars in response to every perceived crisis, it is difficult to argue against the notion that inflation will continue to be an issue going forward.

The current U.S. national debt is unpayable in today’s dollars and growing at an accelerating pace. We are so far beyond the point of no return, that no amount of fiscal responsibility or belt-tightening will get us out of it.

While persistent interest rate hikes have temporarily curtailed runaway inflation, at least in terms of the headline number, the power of the Fed cannot overcome large scale fundamental inflationary forces without tanking the economy. If they were to go that route, raising interest rates into a recession, our current elected officials would be blamed for the economic collapse, leading to regime change and subsequent inflationary policy to be enacted.

If the federal government attempts to tax their way out of debt, the wealthiest U.S. citizens and foreign nationals holding assets here will flee to other nations and take their wealth with them. Once again, this would likely lead to a populist welfare class ideology gaining power in the government, at which point inflation would accelerate to near hyperinflation.

With austerity off the table politically, the obvious truth which most pundits refuse to say aloud is that the U.S. has three options: default on the debt, inflate our way out of debt, or engage in World War III. The rest of the world has taken notice, and behind closed doors they are steadfastly preparing for those three possibilities.

Geopolitical Concerns

The BRICS alliance (Brazil, Russia, India, China, South Africa, and we would throw in Iran and Saudi Arabia for good measure) has strengthened greatly this year and they have resolved to free themselves from dollar dependence. De-dollarization will not happen overnight, not while global trade is dependent on the U.S. Navy patrolling the world’s oceans, but the threat is real.

Brazil is trying to separate themselves from the U.S. dollar as a reserve currency, while simultaneously taking over as the world’s leading agricultural exporter. Russia invaded Ukraine as an affront to NATO. India – the world’s most populous nation – has demonstrated that they have no interest in being beholden to the U.S. China is saber rattling within their home region, preparing to take control of high-tech supply chains, and engaging in cyber and social warfare against the west. South Africa has invited Vladimir Putin to an economic summit next month and stated that attempts to arrest him would be considered an act of war. Iran and Saudi Arabia have put aside their differences as they align with China, with little concern for the objections of the U.S. and European Union.

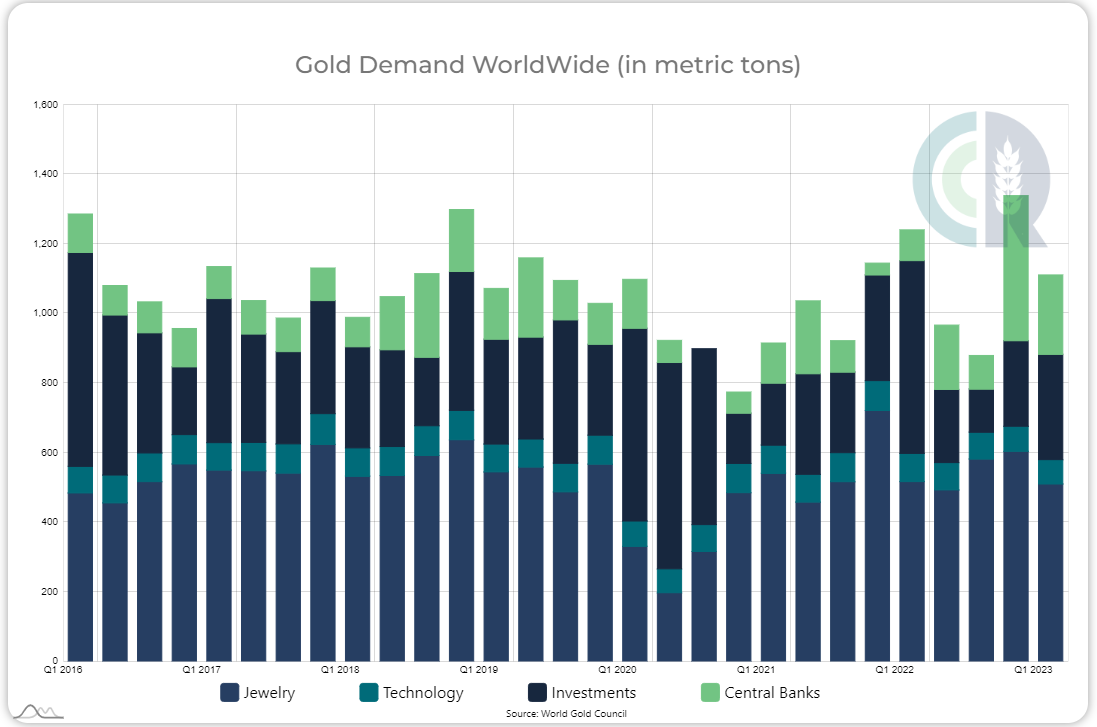

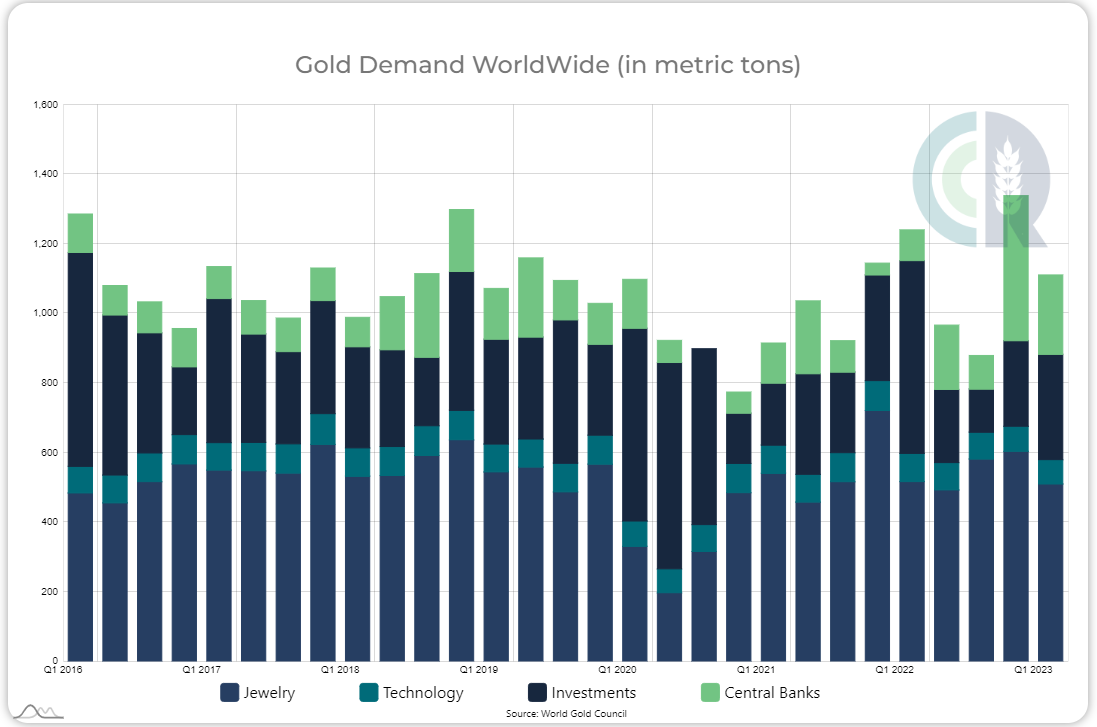

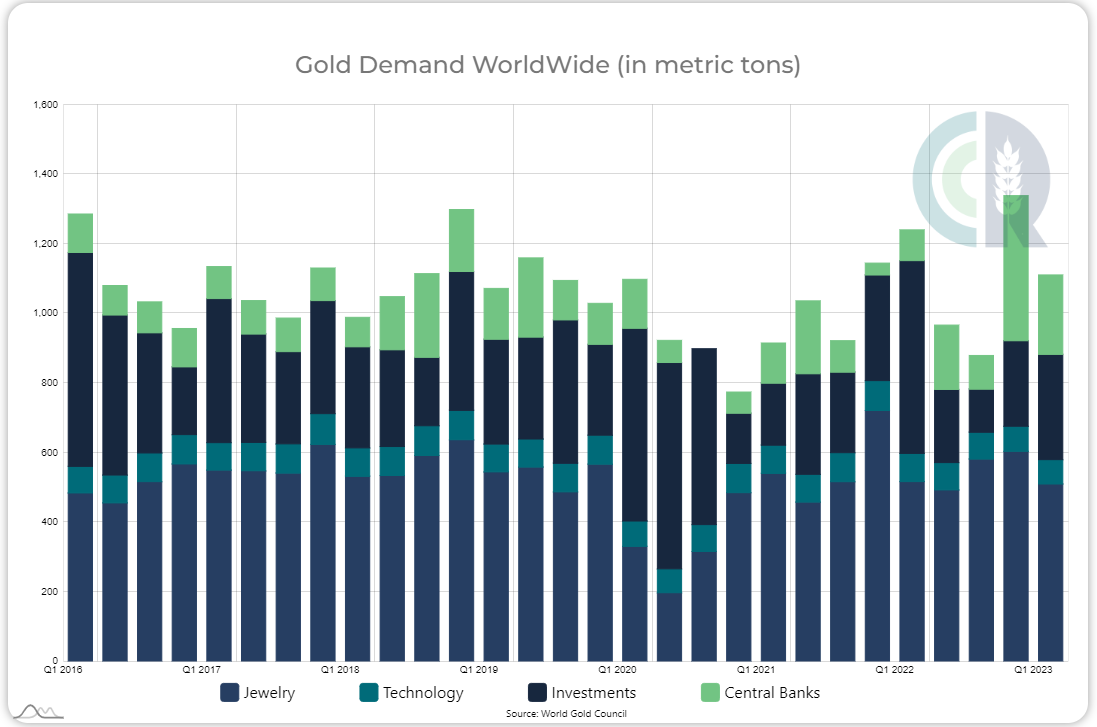

The most notable indicator of a change in sentiment toward the dollar is the purchasing and repatriation of gold by government central banks and private companies or individuals.

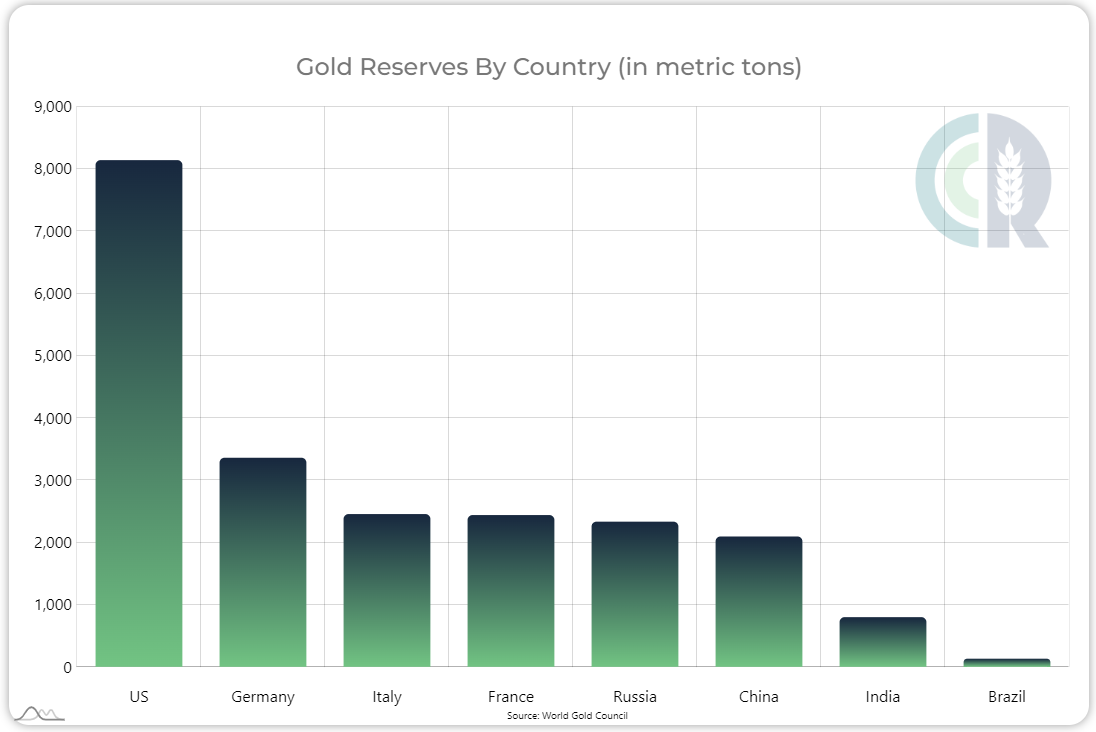

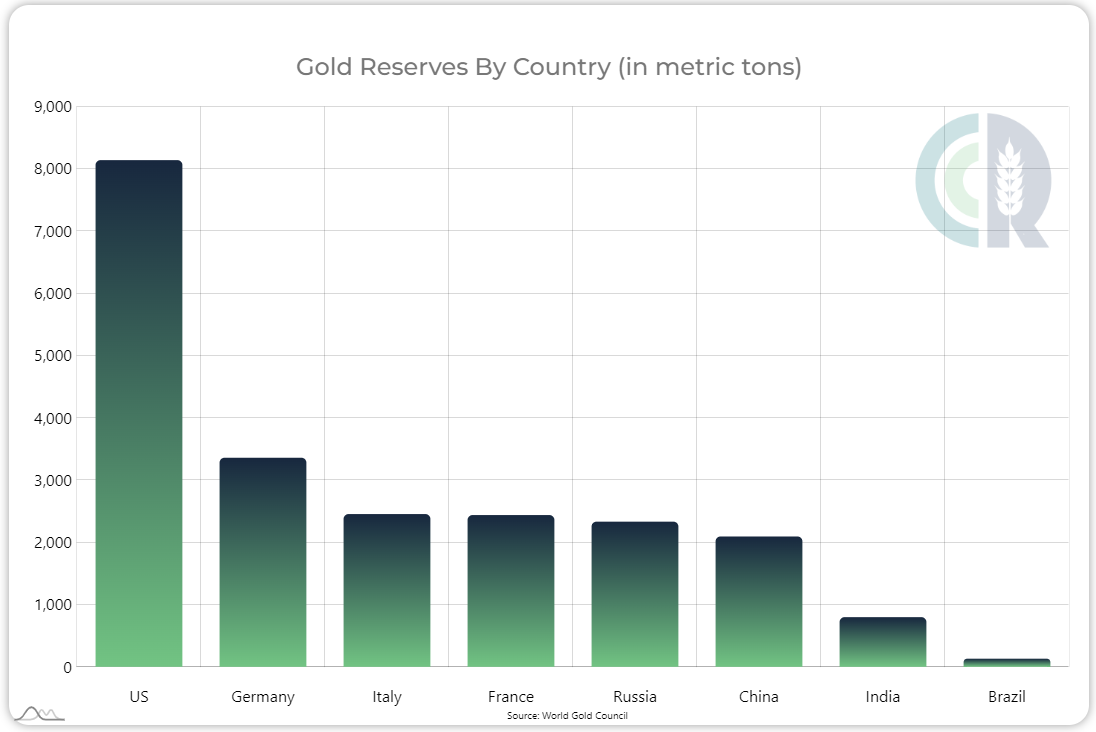

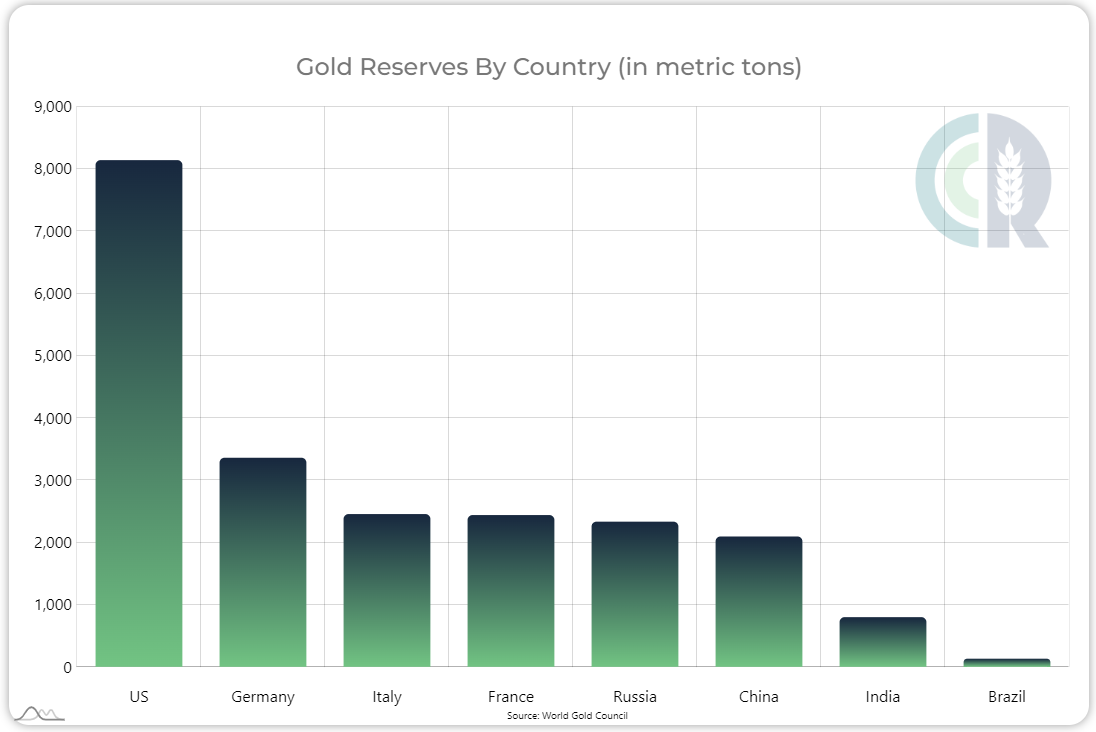

We live in such a dollar-centric world that even those who believe wholeheartedly that the collapse of U.S. hegemony is inevitable are having trouble getting away from the greenback. It is not as if the yuan or euro are better options. The core issue is the lack of confidence in fiat currency in general, with the U.S. dollar being the default and dominant representation of that. Hence, BRICS’s stated interest in creating their own gold-backed currency. They face many difficulties in achieving that goal, most notably that they do not currently own nearly enough gold, but the fact that they are openly attempting it is a paradigm change in and of itself.

Flight to Quality

This is why demand for gold has been rising, and also why people have sought alternatives like Bitcoin. Crypto is interesting, and possibly worth a flier, but it’s not an investment in our eyes. The notion that it will become a unit of exchange beyond government control is a pipe dream. As it requires a computer or smartphone to access, it is at the mercy of tech companies, internet providers, and the National Security Agency. Crypto will have upside only so long as those gatekeepers allow it to exist. If it ever becomes a threat to the existing power structure, it will be shut down.

The more significant aspect of the crypto experiment is that it is a trial balloon for government issued digital currencies, which are likely to infringe upon individual freedom and throw gasoline on the inflation fire. The Fed quietly rolled out the first step toward a central bank digital currency earlier this month with their FedNow payment system. This has led even hardcore crypto enthusiasts to consider physical gold.

Gold is one of a few metals currently experiencing investment in new mine production. In recent years, financial investment from big mining companies mostly involved buying up smaller mining companies. Those were simply balance sheet transactions intended to shift ownership of the gold pie without doing much to increase its overall size. This year, however, mines are physically expanding around the world. Gold mining conglomerates are aggressively spending on land, labor, and equipment, signaling that the organizations which know this industry best are suddenly quite bullish.

Economy’s Impact on Gold Supply

Given all these factors, it’s a wonder that gold has not achieved even greater gains this year. One reason for this is the economic hardship and disparity which has grown dramatically since the pandemic. While economic uncertainty is viewed as a bullish sign by the investor class, it is viewed differently from those struggling to make ends meet.

Internet searches for “pawn shops near me” have spiked this year as cash-strapped, working-class people are forced to sell family heirlooms as inflation raises their cost of living. This small boost to supply has helped keep the price under $2,000 for the moment, but we cannot expect that to last.

Another reason gold’s rally has been held somewhat in check is the psychology of the market, as record high prices tend to be a point of resistance even when the fundamentals indicate it should move higher. Major changes in valuation tend to occur slowly and then all at once. Our simple advice is to make your gold purchases prior to the “all at once” part.

What is the Best Way to Own Gold?

In the most basic sense, the answer is physical bars and coins. However, that leads to the issues of where to keep them and how to conveniently liquidate or convert them to other investments in a timely manner in the future. For long-term macro risk hedging purposes, own physical gold and be smart about where you store it.

The case for gold is not completely reliant on the collapse of our economic system, but on the perceived threat of collapse. Hopefully, we won’t soon be living in a post-apocalyptic future where barter and gold coins are the only means of survival.

For those who see all the cracks in the foundation of our global financial system, but have not gone full-blown doomsday prepper, there is a happy medium to diversify and hedge their portfolios without having to stand guard over a personal vault.

This is where financial instruments become useful. ETFs are the simplest way to invest in gold, especially for those utilizing IRA or 401(k) retirement accounts. Savvy high-net-worth investors looking for nonphysical gold investments utilize commodity futures and options markets. They are “paper” investments with attractive tax incentives, but also have the backing of, and convertibility to, real gold.

Conclusion and Outlook

Don’t risk missing the boat. Establish a position in gold as soon as possible in whichever format best suits your investor profile, but don’t over-leverage. If the price pulls back 5% to 10%, that may be an opportunity to lower your cost basis.

For long-term investors, there is no need to follow the tick-by-tick value on a daily basis. Think of it like buying a house that you plan to live in for the next ten or twenty years. If you have done your research, and stand by your convictions, near-term pullbacks won’t matter in the long run.

Share This Story, Choose Your Platform!

Time May Be Running Out for Patient Gold Bulls

Share This Story, Choose Your Platform

Many long-term gold bulls, us included, have been biding their time over the past few months, waiting for a significant pullback as an opportunity to bolster their positions after the precious metal reached near-record prices earlier this year. A breakout to the upside into new territory seems highly probable. It’s ultimately a question of when such a move might occur.

Traders are apprehensive about pulling the trigger to buy at these levels because they could end up with egg on their face in the event that continued interest rate hikes cause the price to fall back below $1,800 later this year, but the opposite scenario poses a greater asymmetric long-term risk in our opinion.

Given the current macroeconomic and geopolitical circumstances, continuing to wait patiently for a buying opportunity no longer seems like a prudent strategy. Everyone likes to get in at the bottom, but seasoned investors know that it is nearly impossible to achieve perfect timing. There are too many uncontrollable and unpredictable factors at play. With the price of gold currently below $2,000 per ounce, ask yourself which price we are more likely to see next, $1,500 or $2,500?

Near-term Upside Risk Factors for the Price of Gold

A shift from hawkish to dovish Federal Reserve policy, an errant missile intended for Ukraine but landing in a NATO country, a military coup, nuclear strike, rapid devaluation of the United States dollar, upcoming election chaos, civil unrest in America and abroad, reconfiguring of the global trade order, and several other reasonably likely scenarios could be the catalyst that sends gold to the next level. Those threats are hanging over this market like a chandelier of Damoclesian swords. If one of them were to fall, the others may follow, which would cause the price of gold to ascend well beyond the record high of $2,075 set in August 2020.

At that point, technical traders would feel foolish for having tried to squeeze a few more dollars before buying. If one enters a limit order to buy gold futures a few percentage points below the current price, there is a good chance that it will get filled before the end of the year. However, if the price of gold gaps up without warning, which is certainly plausible, they will have missed an opportunity that may never come around again.

Admittedly, we do not have a definitive answer to the question of when this might occur. It could be today, next month, next year, or a few years down the road depending on how several key issues play out.

The Long-Term Fundamental Case for Owning Gold

After three decades with essentially zero inflation, which could more accurately be described as hidden inflation, we witnessed in recent years how quickly it can come roaring back. Most analysts in the market are too young to recall the inflationary period of the 1970s and 1980s, and so they believed the “transitory” narrative of the past two years.

With the Treasury Department and Federal Reserve’s willingness to create trillions of dollars in response to every perceived crisis, it is difficult to argue against the notion that inflation will continue to be an issue going forward.

The current U.S. national debt is unpayable in today’s dollars and growing at an accelerating pace. We are so far beyond the point of no return, that no amount of fiscal responsibility or belt-tightening will get us out of it.

While persistent interest rate hikes have temporarily curtailed runaway inflation, at least in terms of the headline number, the power of the Fed cannot overcome large scale fundamental inflationary forces without tanking the economy. If they were to go that route, raising interest rates into a recession, our current elected officials would be blamed for the economic collapse, leading to regime change and subsequent inflationary policy to be enacted.

If the federal government attempts to tax their way out of debt, the wealthiest U.S. citizens and foreign nationals holding assets here will flee to other nations and take their wealth with them. Once again, this would likely lead to a populist welfare class ideology gaining power in the government, at which point inflation would accelerate to near hyperinflation.

With austerity off the table politically, the obvious truth which most pundits refuse to say aloud is that the U.S. has three options: default on the debt, inflate our way out of debt, or engage in World War III. The rest of the world has taken notice, and behind closed doors they are steadfastly preparing for those three possibilities.

Geopolitical Concerns

The BRICS alliance (Brazil, Russia, India, China, South Africa, and we would throw in Iran and Saudi Arabia for good measure) has strengthened greatly this year and they have resolved to free themselves from dollar dependence. De-dollarization will not happen overnight, not while global trade is dependent on the U.S. Navy patrolling the world’s oceans, but the threat is real.

Brazil is trying to separate themselves from the U.S. dollar as a reserve currency, while simultaneously taking over as the world’s leading agricultural exporter. Russia invaded Ukraine as an affront to NATO. India – the world’s most populous nation – has demonstrated that they have no interest in being beholden to the U.S. China is saber rattling within their home region, preparing to take control of high-tech supply chains, and engaging in cyber and social warfare against the west. South Africa has invited Vladimir Putin to an economic summit next month and stated that attempts to arrest him would be considered an act of war. Iran and Saudi Arabia have put aside their differences as they align with China, with little concern for the objections of the U.S. and European Union.

The most notable indicator of a change in sentiment toward the dollar is the purchasing and repatriation of gold by government central banks and private companies or individuals.

We live in such a dollar-centric world that even those who believe wholeheartedly that the collapse of U.S. hegemony is inevitable are having trouble getting away from the greenback. It is not as if the yuan or euro are better options. The core issue is the lack of confidence in fiat currency in general, with the U.S. dollar being the default and dominant representation of that. Hence, BRICS’s stated interest in creating their own gold-backed currency. They face many difficulties in achieving that goal, most notably that they do not currently own nearly enough gold, but the fact that they are openly attempting it is a paradigm change in and of itself.

Flight to Quality

This is why demand for gold has been rising, and also why people have sought alternatives like Bitcoin. Crypto is interesting, and possibly worth a flier, but it’s not an investment in our eyes. The notion that it will become a unit of exchange beyond government control is a pipe dream. As it requires a computer or smartphone to access, it is at the mercy of tech companies, internet providers, and the National Security Agency. Crypto will have upside only so long as those gatekeepers allow it to exist. If it ever becomes a threat to the existing power structure, it will be shut down.

The more significant aspect of the crypto experiment is that it is a trial balloon for government issued digital currencies, which are likely to infringe upon individual freedom and throw gasoline on the inflation fire. The Fed quietly rolled out the first step toward a central bank digital currency earlier this month with their FedNow payment system. This has led even hardcore crypto enthusiasts to consider physical gold.

Gold is one of a few metals currently experiencing investment in new mine production. In recent years, financial investment from big mining companies mostly involved buying up smaller mining companies. Those were simply balance sheet transactions intended to shift ownership of the gold pie without doing much to increase its overall size. This year, however, mines are physically expanding around the world. Gold mining conglomerates are aggressively spending on land, labor, and equipment, signaling that the organizations which know this industry best are suddenly quite bullish.

Economy’s Impact on Gold Supply

Given all these factors, it’s a wonder that gold has not achieved even greater gains this year. One reason for this is the economic hardship and disparity which has grown dramatically since the pandemic. While economic uncertainty is viewed as a bullish sign by the investor class, it is viewed differently from those struggling to make ends meet.

Internet searches for “pawn shops near me” have spiked this year as cash-strapped, working-class people are forced to sell family heirlooms as inflation raises their cost of living. This small boost to supply has helped keep the price under $2,000 for the moment, but we cannot expect that to last.

Another reason gold’s rally has been held somewhat in check is the psychology of the market, as record high prices tend to be a point of resistance even when the fundamentals indicate it should move higher. Major changes in valuation tend to occur slowly and then all at once. Our simple advice is to make your gold purchases prior to the “all at once” part.

What is the Best Way to Own Gold?

In the most basic sense, the answer is physical bars and coins. However, that leads to the issues of where to keep them and how to conveniently liquidate or convert them to other investments in a timely manner in the future. For long-term macro risk hedging purposes, own physical gold and be smart about where you store it.

The case for gold is not completely reliant on the collapse of our economic system, but on the perceived threat of collapse. Hopefully, we won’t soon be living in a post-apocalyptic future where barter and gold coins are the only means of survival.

For those who see all the cracks in the foundation of our global financial system, but have not gone full-blown doomsday prepper, there is a happy medium to diversify and hedge their portfolios without having to stand guard over a personal vault.

This is where financial instruments become useful. ETFs are the simplest way to invest in gold, especially for those utilizing IRA or 401(k) retirement accounts. Savvy high-net-worth investors looking for nonphysical gold investments utilize commodity futures and options markets. They are “paper” investments with attractive tax incentives, but also have the backing of, and convertibility to, real gold.

Conclusion and Outlook

Don’t risk missing the boat. Establish a position in gold as soon as possible in whichever format best suits your investor profile, but don’t over-leverage. If the price pulls back 5% to 10%, that may be an opportunity to lower your cost basis.

For long-term investors, there is no need to follow the tick-by-tick value on a daily basis. Think of it like buying a house that you plan to live in for the next ten or twenty years. If you have done your research, and stand by your convictions, near-term pullbacks won’t matter in the long run.

Share This Story, Choose Your Platform!

Time May Be Running Out for Patient Gold Bulls

Share This Story, Choose Your Platform

Many long-term gold bulls, us included, have been biding their time over the past few months, waiting for a significant pullback as an opportunity to bolster their positions after the precious metal reached near-record prices earlier this year. A breakout to the upside into new territory seems highly probable. It’s ultimately a question of when such a move might occur.

Traders are apprehensive about pulling the trigger to buy at these levels because they could end up with egg on their face in the event that continued interest rate hikes cause the price to fall back below $1,800 later this year, but the opposite scenario poses a greater asymmetric long-term risk in our opinion.

Given the current macroeconomic and geopolitical circumstances, continuing to wait patiently for a buying opportunity no longer seems like a prudent strategy. Everyone likes to get in at the bottom, but seasoned investors know that it is nearly impossible to achieve perfect timing. There are too many uncontrollable and unpredictable factors at play. With the price of gold currently below $2,000 per ounce, ask yourself which price we are more likely to see next, $1,500 or $2,500?

Near-term Upside Risk Factors for the Price of Gold

A shift from hawkish to dovish Federal Reserve policy, an errant missile intended for Ukraine but landing in a NATO country, a military coup, nuclear strike, rapid devaluation of the United States dollar, upcoming election chaos, civil unrest in America and abroad, reconfiguring of the global trade order, and several other reasonably likely scenarios could be the catalyst that sends gold to the next level. Those threats are hanging over this market like a chandelier of Damoclesian swords. If one of them were to fall, the others may follow, which would cause the price of gold to ascend well beyond the record high of $2,075 set in August 2020.

At that point, technical traders would feel foolish for having tried to squeeze a few more dollars before buying. If one enters a limit order to buy gold futures a few percentage points below the current price, there is a good chance that it will get filled before the end of the year. However, if the price of gold gaps up without warning, which is certainly plausible, they will have missed an opportunity that may never come around again.

Admittedly, we do not have a definitive answer to the question of when this might occur. It could be today, next month, next year, or a few years down the road depending on how several key issues play out.

The Long-Term Fundamental Case for Owning Gold

After three decades with essentially zero inflation, which could more accurately be described as hidden inflation, we witnessed in recent years how quickly it can come roaring back. Most analysts in the market are too young to recall the inflationary period of the 1970s and 1980s, and so they believed the “transitory” narrative of the past two years.

With the Treasury Department and Federal Reserve’s willingness to create trillions of dollars in response to every perceived crisis, it is difficult to argue against the notion that inflation will continue to be an issue going forward.

The current U.S. national debt is unpayable in today’s dollars and growing at an accelerating pace. We are so far beyond the point of no return, that no amount of fiscal responsibility or belt-tightening will get us out of it.

While persistent interest rate hikes have temporarily curtailed runaway inflation, at least in terms of the headline number, the power of the Fed cannot overcome large scale fundamental inflationary forces without tanking the economy. If they were to go that route, raising interest rates into a recession, our current elected officials would be blamed for the economic collapse, leading to regime change and subsequent inflationary policy to be enacted.

If the federal government attempts to tax their way out of debt, the wealthiest U.S. citizens and foreign nationals holding assets here will flee to other nations and take their wealth with them. Once again, this would likely lead to a populist welfare class ideology gaining power in the government, at which point inflation would accelerate to near hyperinflation.

With austerity off the table politically, the obvious truth which most pundits refuse to say aloud is that the U.S. has three options: default on the debt, inflate our way out of debt, or engage in World War III. The rest of the world has taken notice, and behind closed doors they are steadfastly preparing for those three possibilities.

Geopolitical Concerns

The BRICS alliance (Brazil, Russia, India, China, South Africa, and we would throw in Iran and Saudi Arabia for good measure) has strengthened greatly this year and they have resolved to free themselves from dollar dependence. De-dollarization will not happen overnight, not while global trade is dependent on the U.S. Navy patrolling the world’s oceans, but the threat is real.

Brazil is trying to separate themselves from the U.S. dollar as a reserve currency, while simultaneously taking over as the world’s leading agricultural exporter. Russia invaded Ukraine as an affront to NATO. India – the world’s most populous nation – has demonstrated that they have no interest in being beholden to the U.S. China is saber rattling within their home region, preparing to take control of high-tech supply chains, and engaging in cyber and social warfare against the west. South Africa has invited Vladimir Putin to an economic summit next month and stated that attempts to arrest him would be considered an act of war. Iran and Saudi Arabia have put aside their differences as they align with China, with little concern for the objections of the U.S. and European Union.

The most notable indicator of a change in sentiment toward the dollar is the purchasing and repatriation of gold by government central banks and private companies or individuals.

We live in such a dollar-centric world that even those who believe wholeheartedly that the collapse of U.S. hegemony is inevitable are having trouble getting away from the greenback. It is not as if the yuan or euro are better options. The core issue is the lack of confidence in fiat currency in general, with the U.S. dollar being the default and dominant representation of that. Hence, BRICS’s stated interest in creating their own gold-backed currency. They face many difficulties in achieving that goal, most notably that they do not currently own nearly enough gold, but the fact that they are openly attempting it is a paradigm change in and of itself.

Flight to Quality

This is why demand for gold has been rising, and also why people have sought alternatives like Bitcoin. Crypto is interesting, and possibly worth a flier, but it’s not an investment in our eyes. The notion that it will become a unit of exchange beyond government control is a pipe dream. As it requires a computer or smartphone to access, it is at the mercy of tech companies, internet providers, and the National Security Agency. Crypto will have upside only so long as those gatekeepers allow it to exist. If it ever becomes a threat to the existing power structure, it will be shut down.

The more significant aspect of the crypto experiment is that it is a trial balloon for government issued digital currencies, which are likely to infringe upon individual freedom and throw gasoline on the inflation fire. The Fed quietly rolled out the first step toward a central bank digital currency earlier this month with their FedNow payment system. This has led even hardcore crypto enthusiasts to consider physical gold.

Gold is one of a few metals currently experiencing investment in new mine production. In recent years, financial investment from big mining companies mostly involved buying up smaller mining companies. Those were simply balance sheet transactions intended to shift ownership of the gold pie without doing much to increase its overall size. This year, however, mines are physically expanding around the world. Gold mining conglomerates are aggressively spending on land, labor, and equipment, signaling that the organizations which know this industry best are suddenly quite bullish.

Economy’s Impact on Gold Supply

Given all these factors, it’s a wonder that gold has not achieved even greater gains this year. One reason for this is the economic hardship and disparity which has grown dramatically since the pandemic. While economic uncertainty is viewed as a bullish sign by the investor class, it is viewed differently from those struggling to make ends meet.

Internet searches for “pawn shops near me” have spiked this year as cash-strapped, working-class people are forced to sell family heirlooms as inflation raises their cost of living. This small boost to supply has helped keep the price under $2,000 for the moment, but we cannot expect that to last.

Another reason gold’s rally has been held somewhat in check is the psychology of the market, as record high prices tend to be a point of resistance even when the fundamentals indicate it should move higher. Major changes in valuation tend to occur slowly and then all at once. Our simple advice is to make your gold purchases prior to the “all at once” part.

What is the Best Way to Own Gold?

In the most basic sense, the answer is physical bars and coins. However, that leads to the issues of where to keep them and how to conveniently liquidate or convert them to other investments in a timely manner in the future. For long-term macro risk hedging purposes, own physical gold and be smart about where you store it.

The case for gold is not completely reliant on the collapse of our economic system, but on the perceived threat of collapse. Hopefully, we won’t soon be living in a post-apocalyptic future where barter and gold coins are the only means of survival.

For those who see all the cracks in the foundation of our global financial system, but have not gone full-blown doomsday prepper, there is a happy medium to diversify and hedge their portfolios without having to stand guard over a personal vault.

This is where financial instruments become useful. ETFs are the simplest way to invest in gold, especially for those utilizing IRA or 401(k) retirement accounts. Savvy high-net-worth investors looking for nonphysical gold investments utilize commodity futures and options markets. They are “paper” investments with attractive tax incentives, but also have the backing of, and convertibility to, real gold.

Conclusion and Outlook

Don’t risk missing the boat. Establish a position in gold as soon as possible in whichever format best suits your investor profile, but don’t over-leverage. If the price pulls back 5% to 10%, that may be an opportunity to lower your cost basis.

For long-term investors, there is no need to follow the tick-by-tick value on a daily basis. Think of it like buying a house that you plan to live in for the next ten or twenty years. If you have done your research, and stand by your convictions, near-term pullbacks won’t matter in the long run.