WTI Futures Rebound Quickly With Help From Federal Reserve, OPEC+

Share This Story, Choose Your Platform!

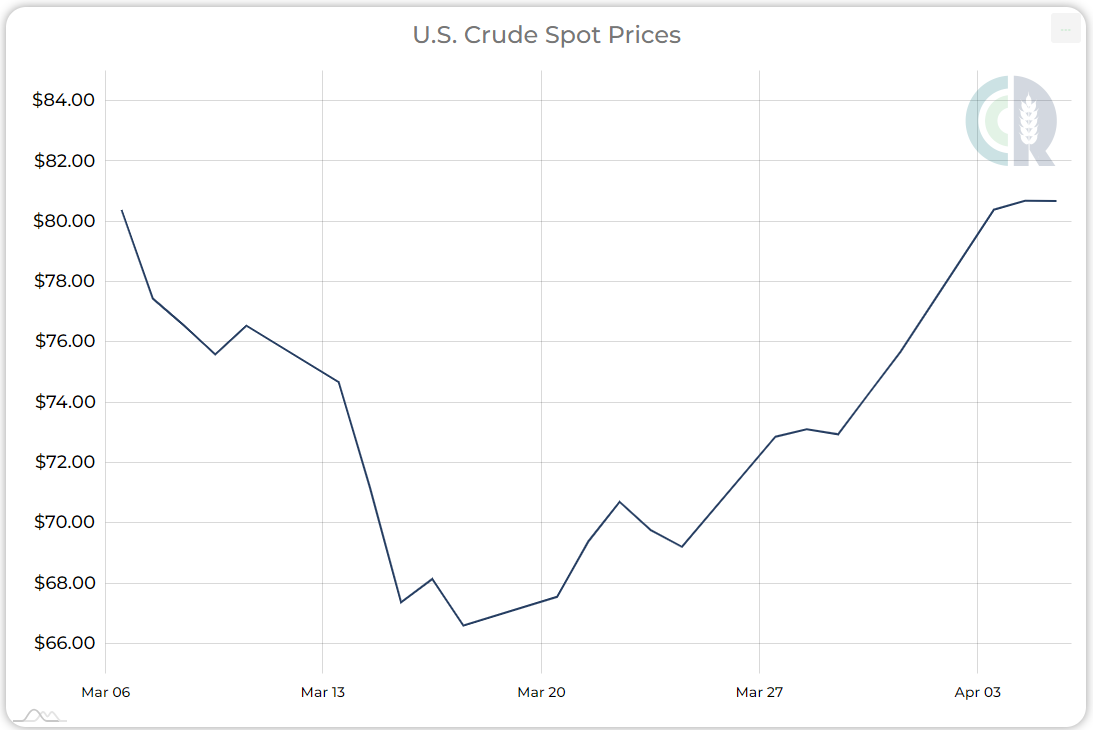

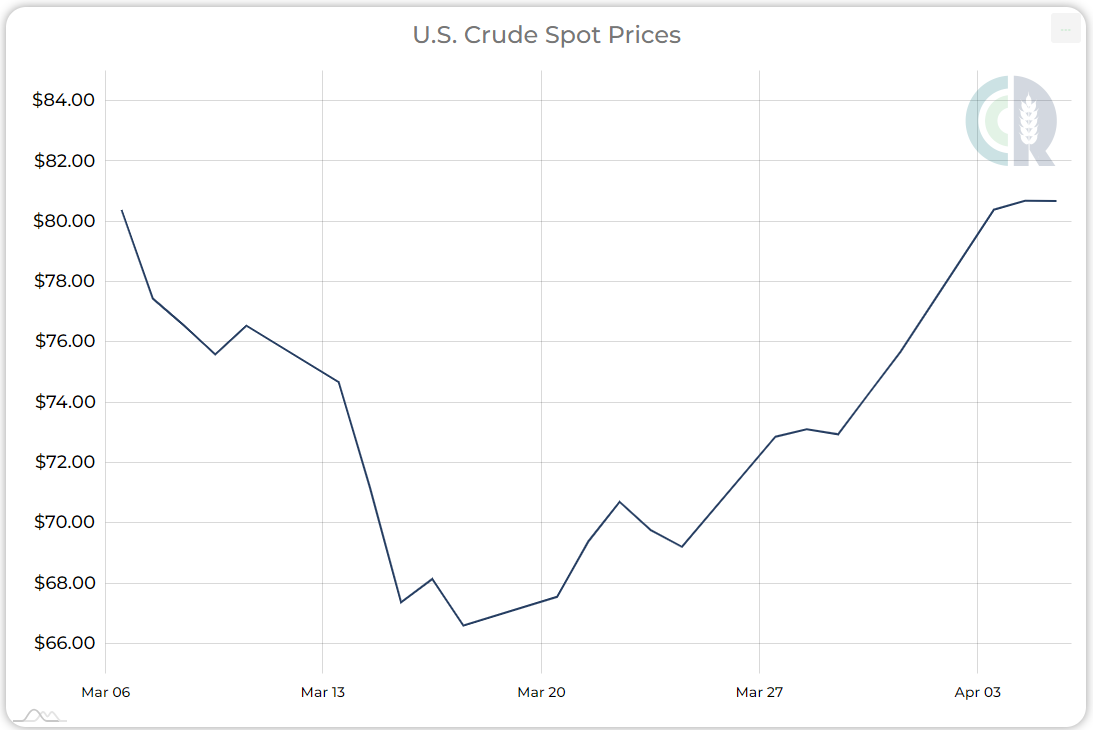

Speculators began the month of March with bullish sentiment until the banking scare took the price of West Texas Intermediate (WTI) from $80 down to $66. Central banks softened their stance on rate hikes in response, allowing the price to bounce back above $70. Brazil’s announcement that they would join China in using their currency for international trade exacerbated concerns about weakness of the U.S. dollar. Just as oil bears began to cover short positions, OPEC announced a cut of over one million barrels which sent futures back above $80 to start the month of April. Now that the systemic threat to our financial system seems to have passed, WTI is back to where it was before that threat.

Our previous crude oil report called for pinball volatility to persist within a window of $60 to $90. So far that forecast has held up, but how might recent events change the market outlook going forward?

Short-term Factors

OPEC’s decision to lower production limits was widely reported as a “surprise”. The truth is it was predictable, given that just a few weeks earlier the price of crude reached new multi-year lows. The United States failed to begin replenishing the Strategic Petroleum Reserve as promised when the price of WTI fell below $72. This is what drove Saudi Arabia and the rest of OPEC+ to take action.

Oil bulls are again discussing $100 per barrel, and while we can’t rule that out completely, it’s unlikely in the near-term given the current supply and demand outlook. With a hard landing recession appearing more and more likely, our economy will not be able to sustain that price.

Even if the economy proves resilient, the supply side of the equation will likely keep oil prices in check. With domestic production already near all-time highs, and the Alaskan Willow Project in the works, OPEC does not want to create any more profit incentives for their Western rivals. The sweet spot for OPEC is $80 to $85, and they will increase production if prices significantly exceed that range.

Another headwind, should the price of WTI begin to flirt with the century-mark, will be the Biden Administration’s use of the Strategic Petroleum Reserve, or what’s left of it. The SPR is helping to bookend this market by threatening to either sell millions of barrels at $100+, or buy millions of barrels for $65. While that wouldn’t be enough to contain the price in the face of changing fundamentals, it will serve to keep a fundamentally sideways market from wandering too far out of its lane.

Therefore, our 2023 outlook is largely unchanged by recent events, but the multi-year forecast may need adjustment.

Long-term Factors

The relationship between China and Russia has grown much stronger since the war in Ukraine began. Putin is desperate for an ally and has immense natural resources to share. China needs those natural resources, has a vested interest in weakening the U.S./NATO position, and sees this as an opportunity to take a leadership role on the world stage.

It was a bit surprising how quickly some other nations moved in that direction. India basically ignored the sanctions against Russia from the outset, taking the position that their people need energy and they will buy it from the cheapest available source. Brazil’s decision to align themselves with China, and to some degree Russia, was an unexpected gut-punch to U.S. interests.

Even France, the oldest and still one of the closest U.S. allies, has gotten in on the action by completing a Liquified Natural Gas (LNG) transaction with China in yuan.

Most recently, Saudi Arabia cut 500kb/d (part of the overall OPEC cut of 1.2mb/d) despite pleas from The White House to keep up production. Saudi Arabia has long been beholden to the U. S. militarily, but Mohammed bin Salman has been willing to test that relationship.

The U.S. is perceived to be losing influence around the globe, and that is potentially the most important development from these recent events in the oil market. Brazil, Russia, India, and China make a formidable alliance, as they are some of the most influential nations when it comes to commodity trade.

The moniker of BRIC for Brazil, Russia, India, and China, was coined in 2001 to describe fast-growing nations that were expected to increase their role in the global economy. Later an “S” was added for South Africa, but perhaps in the future it will stand for Saudi Arabia.

What Will a Stronger BRIC(S) Alliance Mean for The Petrodollar?

The bond between China and Russia will continue to strengthen, as both nations need one another. Russia has the natural resources, but not enough skilled manpower to exploit them. China can send engineers and laborers to reopen drilling sites previously operated by Western corporations and abandoned after the invasion of Ukraine. Watch for China’s influence over Russian energy exports to grow, giving them negotiating leverage against Middle Eastern suppliers.

Brazil sees the potential benefits of this alternative trading network and is jumping on board, bringing their own vast lineup of agricultural products to the table. Now that Brazil is in China’s corner, or at least playing both sides, China is not completely dependent on the U.S. dollar-denominated trade markets to feed their population. With energy coming from Russia, agricultural products from Brazil, and an array of commodities from Africa, China has their bare necessities squared away in the event of World War III.

Reclaiming dollar dominance is a top priority for the United States, so it will try to strengthen the NATO alliance and keep as many nations as possible on its side. The military alliance with Saudi Arabia is essential to maintaining the petrodollar, so we may see an increase in weapons and equipment sent to the kingdom over the next few years. Bringing India and Brazil back into the fold will require favorable (to them) trade deals. Maintaining, or reattaining, global hegemony will be a costly proposition.

Conclusion

Putting aside the short-term effect of the OPEC cut, crude oil is becoming more of a buyer’s market. The top producing nations within OPEC+ have competing interests that weaken the resolve of the cartel. Russia has been forced to undercut competitors, and their recent output reduction had more to do with logistics than price strategy.

Non-OPEC+ nations have been raising output, mitigating the impact of OPEC’s decision. The United States, while publicly promoting renewable energy projects, is quietly moving toward all-time record output of oil and gas.

Environmental concerns have taken a back seat to inflation. Political realities will make the price of gasoline a focal point of public policy leading up to next year’s election. Domestic drilling can be sold to the public as a tool to weaken Putin, which will help silence any lingering dissent from climate activists.

With the reopening of China still in progress, the IEA anticipates global crude oil demand will grow by 2mb/d in 2023, compared with only a 1.2mb/d increase in production. We expect both domestic and global crude oil production to outpace estimates over the next two years, and prices to merely keep pace with inflation as the floodgates are opened.

Share This Story, Choose Your Platform!

WTI Futures Rebound Quickly With Help From Federal Reserve, OPEC+

Share This Story, Choose Your Platform

Speculators began the month of March with bullish sentiment until the banking scare took the price of West Texas Intermediate (WTI) from $80 down to $66. Central banks softened their stance on rate hikes in response, allowing the price to bounce back above $70. Brazil’s announcement that they would join China in using their currency for international trade exacerbated concerns about weakness of the U.S. dollar. Just as oil bears began to cover short positions, OPEC announced a cut of over one million barrels which sent futures back above $80 to start the month of April. Now that the systemic threat to our financial system seems to have passed, WTI is back to where it was before that threat.

Our previous crude oil report called for pinball volatility to persist within a window of $60 to $90. So far that forecast has held up, but how might recent events change the market outlook going forward?

Short-term Factors

OPEC’s decision to lower production limits was widely reported as a “surprise”. The truth is it was predictable, given that just a few weeks earlier the price of crude reached new multi-year lows. The United States failed to begin replenishing the Strategic Petroleum Reserve as promised when the price of WTI fell below $72. This is what drove Saudi Arabia and the rest of OPEC+ to take action.

Oil bulls are again discussing $100 per barrel, and while we can’t rule that out completely, it’s unlikely in the near-term given the current supply and demand outlook. With a hard landing recession appearing more and more likely, our economy will not be able to sustain that price.

Even if the economy proves resilient, the supply side of the equation will likely keep oil prices in check. With domestic production already near all-time highs, and the Alaskan Willow Project in the works, OPEC does not want to create any more profit incentives for their Western rivals. The sweet spot for OPEC is $80 to $85, and they will increase production if prices significantly exceed that range.

Another headwind, should the price of WTI begin to flirt with the century-mark, will be the Biden Administration’s use of the Strategic Petroleum Reserve, or what’s left of it. The SPR is helping to bookend this market by threatening to either sell millions of barrels at $100+, or buy millions of barrels for $65. While that wouldn’t be enough to contain the price in the face of changing fundamentals, it will serve to keep a fundamentally sideways market from wandering too far out of its lane.

Therefore, our 2023 outlook is largely unchanged by recent events, but the multi-year forecast may need adjustment.

Long-term Factors

The relationship between China and Russia has grown much stronger since the war in Ukraine began. Putin is desperate for an ally and has immense natural resources to share. China needs those natural resources, has a vested interest in weakening the U.S./NATO position, and sees this as an opportunity to take a leadership role on the world stage.

It was a bit surprising how quickly some other nations moved in that direction. India basically ignored the sanctions against Russia from the outset, taking the position that their people need energy and they will buy it from the cheapest available source. Brazil’s decision to align themselves with China, and to some degree Russia, was an unexpected gut-punch to U.S. interests.

Even France, the oldest and still one of the closest U.S. allies, has gotten in on the action by completing a Liquified Natural Gas (LNG) transaction with China in yuan.

Most recently, Saudi Arabia cut 500kb/d (part of the overall OPEC cut of 1.2mb/d) despite pleas from The White House to keep up production. Saudi Arabia has long been beholden to the U. S. militarily, but Mohammed bin Salman has been willing to test that relationship.

The U.S. is perceived to be losing influence around the globe, and that is potentially the most important development from these recent events in the oil market. Brazil, Russia, India, and China make a formidable alliance, as they are some of the most influential nations when it comes to commodity trade.

The moniker of BRIC for Brazil, Russia, India, and China, was coined in 2001 to describe fast-growing nations that were expected to increase their role in the global economy. Later an “S” was added for South Africa, but perhaps in the future it will stand for Saudi Arabia.

What Will a Stronger BRIC(S) Alliance Mean for The Petrodollar?

The bond between China and Russia will continue to strengthen, as both nations need one another. Russia has the natural resources, but not enough skilled manpower to exploit them. China can send engineers and laborers to reopen drilling sites previously operated by Western corporations and abandoned after the invasion of Ukraine. Watch for China’s influence over Russian energy exports to grow, giving them negotiating leverage against Middle Eastern suppliers.

Brazil sees the potential benefits of this alternative trading network and is jumping on board, bringing their own vast lineup of agricultural products to the table. Now that Brazil is in China’s corner, or at least playing both sides, China is not completely dependent on the U.S. dollar-denominated trade markets to feed their population. With energy coming from Russia, agricultural products from Brazil, and an array of commodities from Africa, China has their bare necessities squared away in the event of World War III.

Reclaiming dollar dominance is a top priority for the United States, so it will try to strengthen the NATO alliance and keep as many nations as possible on its side. The military alliance with Saudi Arabia is essential to maintaining the petrodollar, so we may see an increase in weapons and equipment sent to the kingdom over the next few years. Bringing India and Brazil back into the fold will require favorable (to them) trade deals. Maintaining, or reattaining, global hegemony will be a costly proposition.

Conclusion

Putting aside the short-term effect of the OPEC cut, crude oil is becoming more of a buyer’s market. The top producing nations within OPEC+ have competing interests that weaken the resolve of the cartel. Russia has been forced to undercut competitors, and their recent output reduction had more to do with logistics than price strategy.

Non-OPEC+ nations have been raising output, mitigating the impact of OPEC’s decision. The United States, while publicly promoting renewable energy projects, is quietly moving toward all-time record output of oil and gas.

Environmental concerns have taken a back seat to inflation. Political realities will make the price of gasoline a focal point of public policy leading up to next year’s election. Domestic drilling can be sold to the public as a tool to weaken Putin, which will help silence any lingering dissent from climate activists.

With the reopening of China still in progress, the IEA anticipates global crude oil demand will grow by 2mb/d in 2023, compared with only a 1.2mb/d increase in production. We expect both domestic and global crude oil production to outpace estimates over the next two years, and prices to merely keep pace with inflation as the floodgates are opened.