Coffee Prices Face Long-Term Bearish Fundamentals but Short-Term Upside Risk

Share This Story, Choose Your Platform!

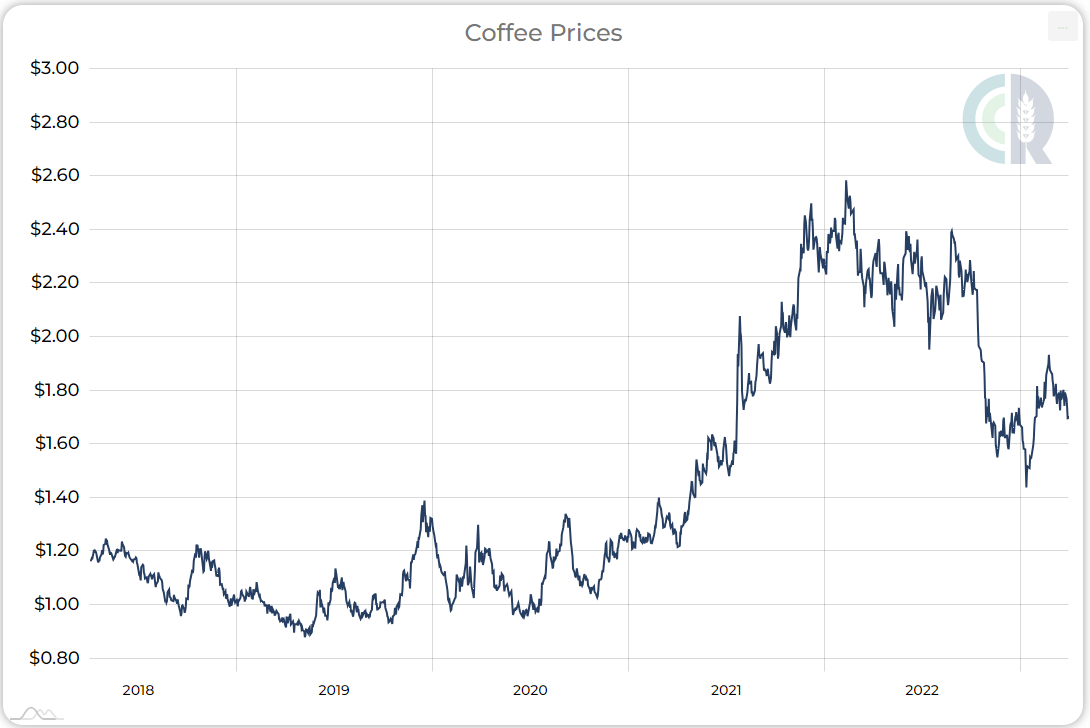

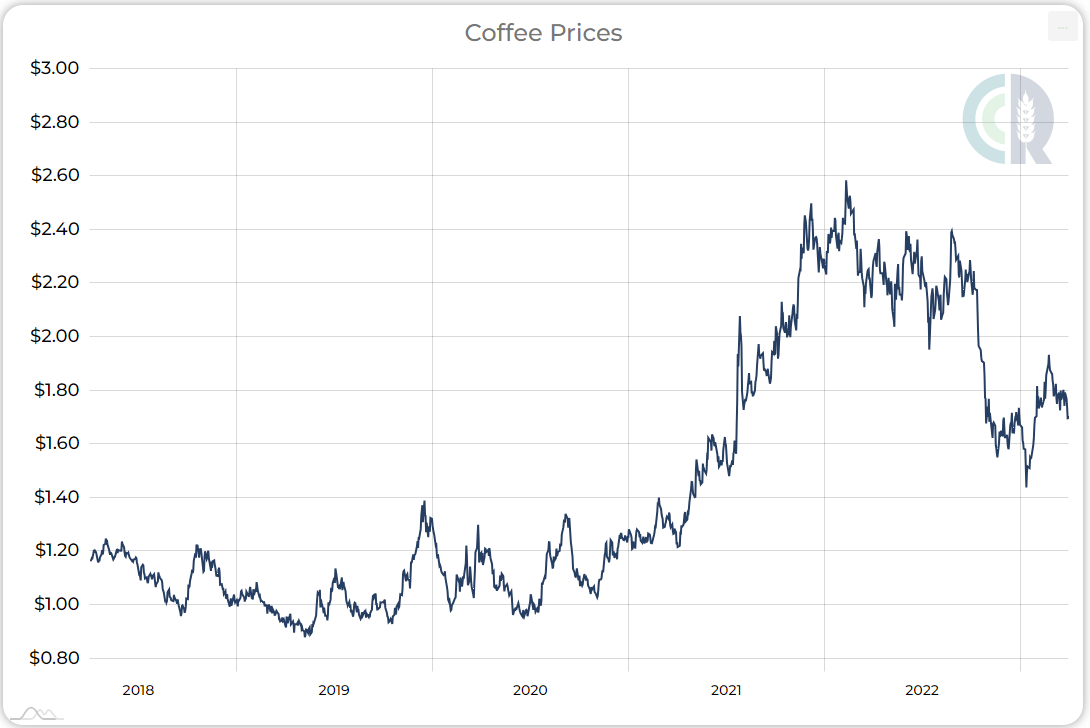

ICE Coffee futures posted a 10-year high over $2.50 per pound in February 2022, riding largely on the wings of commodities inflation and a small Brazilian harvest. And while prices remained firm for much of last year, 2023 ushered in a price nosedive below $1.50.

With coffee prices now hovering back near $2, the coffee market is starting to feel fundamentally overvalued. But bears need to show some caution before going all in on the shorts.

The U.S. dollar is still in decline, with bank failures and threats of de-dollarization weighing heavily on the minds of speculators. Dollar weakness and the strength of the Brazilian Real has been a supportive factor to coffee in recent weeks. The expected softening of the economy in the United States and globally in 2023 is providing some counterweight to those inflationary pressures.

Bearish Supply-Side Fundamentals

The bearish case for coffee stems from the outstanding growing conditions in Brazil this year. NOAA (the National Oceanic and Atmospheric Administration) announced in February that La Nina had ended. This means moderate weather in South America is likely throughout the remainder of this growing season.

Soil health, rainfall totals, and crop inspections in Brazil all point to a small rebound in coffee production this year and a potential massive harvest in store for the 2023/2024 crop year. With harvesting currently underway, Brazil is expected to net 62.6 million bags of coffee this year, compared to 58.1 million bags in 2022 and a record 69.9 million bags in 2021.

As the market is always forward-looking, next year’s crop is starting to come into focus. A preliminary look at the condition of Brazilian coffee trees indicates 2023/2024 could be very healthy. Early estimates range from 62 million to 67 million bags, but we see potential to exceed that if the weather continues to cooperate.

Production in Vietnam, the world’s number two producer of coffee, also appears strong this year. Vietnam will harvest 30.2 million bags of coffee in 2023, compared to 31.6 million bags in 2022 and 29 million bags in 2021.

Worldwide production is expected to recover to 172.75 million bags, after a down year of 166 million bags. Ample production should cast a bearish pall over coffee prices in the second half of 2023.

Bears, however, must still contend with some near-term bullish counter forces in the market.

Upside Risk Factors in Coffee

South American extended forecasts call for heavier-than-usual rain in April and May, which could delay the harvest progress and even damage the upcoming crop. While these are real concerns, the risk appears minimal as it would take several weeks of heavy rain to significantly hurt production.

Frost is an annual danger to Brazilian coffee trees from June through August. For all the discussion about optimal or suboptimal growing conditions, the biggest factor in Brazilian production areas is whether the temperature remains above 32 degrees Fahrenheit. While the frost threat is reduced by the passing of La Niña, bears must keep a wary eye on weather when holding short positions during southern hemisphere winters.

Of more immediate impact to coffee prices are ICE Exchange stocks which have plummeted and are on track for their third straight monthly decline. Current stocks are already more than 32,000 bags below their March end of month totals. This shortfall has largely been the driver behind the current price push above $2.

We expect exchange stocks to begin recovering as the new Brazilian crop works its way through supply channels. In the meantime, upside price pressure could continue.

This kind of price strength can feed on itself. Coffee producers will hold the line on price for as long as they can, hoping weather will help them secure a higher price. But they also know how fast the bottom could fall out of this market if neither of those threats materialize. It’s a strategic gamble. Farmers already sold part of this year’s harvest at historic levels, so they may feel like they’re playing with house money now.

Conclusion and Strategy

We would not recommend attempting to call a top in this market until the weather-related threats have passed. At that point, there may still be an opportunity to jump on the bearish bandwagon for the second half of the year. Assuming there is not a major crop damaging event, the world will be awash in coffee supply this fall and into next year. Markets will have to price that in sooner or later.

Share This Story, Choose Your Platform!

Coffee Prices Face Long-Term Bearish Fundamentals but Short-Term Upside Risk

Share This Story, Choose Your Platform

ICE Coffee futures posted a 10-year high over $2.50 per pound in February 2022, riding largely on the wings of commodities inflation and a small Brazilian harvest. And while prices remained firm for much of last year, 2023 ushered in a price nosedive below $1.50.

With coffee prices now hovering back near $2, the coffee market is starting to feel fundamentally overvalued. But bears need to show some caution before going all in on the shorts.

The U.S. dollar is still in decline, with bank failures and threats of de-dollarization weighing heavily on the minds of speculators. Dollar weakness and the strength of the Brazilian Real has been a supportive factor to coffee in recent weeks. The expected softening of the economy in the United States and globally in 2023 is providing some counterweight to those inflationary pressures.

Bearish Supply-Side Fundamentals

The bearish case for coffee stems from the outstanding growing conditions in Brazil this year. NOAA (the National Oceanic and Atmospheric Administration) announced in February that La Nina had ended. This means moderate weather in South America is likely throughout the remainder of this growing season.

Soil health, rainfall totals, and crop inspections in Brazil all point to a small rebound in coffee production this year and a potential massive harvest in store for the 2023/2024 crop year. With harvesting currently underway, Brazil is expected to net 62.6 million bags of coffee this year, compared to 58.1 million bags in 2022 and a record 69.9 million bags in 2021.

As the market is always forward-looking, next year’s crop is starting to come into focus. A preliminary look at the condition of Brazilian coffee trees indicates 2023/2024 could be very healthy. Early estimates range from 62 million to 67 million bags, but we see potential to exceed that if the weather continues to cooperate.

Production in Vietnam, the world’s number two producer of coffee, also appears strong this year. Vietnam will harvest 30.2 million bags of coffee in 2023, compared to 31.6 million bags in 2022 and 29 million bags in 2021.

Worldwide production is expected to recover to 172.75 million bags, after a down year of 166 million bags. Ample production should cast a bearish pall over coffee prices in the second half of 2023.

Bears, however, must still contend with some near-term bullish counter forces in the market.

Upside Risk Factors in Coffee

South American extended forecasts call for heavier-than-usual rain in April and May, which could delay the harvest progress and even damage the upcoming crop. While these are real concerns, the risk appears minimal as it would take several weeks of heavy rain to significantly hurt production.

Frost is an annual danger to Brazilian coffee trees from June through August. For all the discussion about optimal or suboptimal growing conditions, the biggest factor in Brazilian production areas is whether the temperature remains above 32 degrees Fahrenheit. While the frost threat is reduced by the passing of La Niña, bears must keep a wary eye on weather when holding short positions during southern hemisphere winters.

Of more immediate impact to coffee prices are ICE Exchange stocks which have plummeted and are on track for their third straight monthly decline. Current stocks are already more than 32,000 bags below their March end of month totals. This shortfall has largely been the driver behind the current price push above $2.

We expect exchange stocks to begin recovering as the new Brazilian crop works its way through supply channels. In the meantime, upside price pressure could continue.

This kind of price strength can feed on itself. Coffee producers will hold the line on price for as long as they can, hoping weather will help them secure a higher price. But they also know how fast the bottom could fall out of this market if neither of those threats materialize. It’s a strategic gamble. Farmers already sold part of this year’s harvest at historic levels, so they may feel like they’re playing with house money now.

Conclusion and Strategy

We would not recommend attempting to call a top in this market until the weather-related threats have passed. At that point, there may still be an opportunity to jump on the bearish bandwagon for the second half of the year. Assuming there is not a major crop damaging event, the world will be awash in coffee supply this fall and into next year. Markets will have to price that in sooner or later.