Love’s Price Tag: How High Cocoa Market Costs Could Sour Valentine’s Chocolate

Share This Story, Choose Your Platform!

The Cocoa Market

As we approach Valentine’s Day, a key season for cocoa consumption, the cocoa futures market is under intense scrutiny. This period traditionally sees an uptick in demand for chocolate, making it a critical time for producers and investors in the cocoa industry. However, the current market dynamics, influenced by supply constraints, climatic adversities, and evolving consumer behavior, present a complex landscape to navigate.

The cocoa market is currently facing a pivotal juncture, influenced significantly by the supply-side challenges emanating from West Africa, the epicenter of global cocoa production. This region, responsible for over 75% of the world’s cocoa supply, has been hit by a series of climatic challenges that have raised alarms about potential shortfalls in production. The El Niño phenomenon, known for bringing hot and dry conditions, threatens the usual crop cycles, exacerbating the supply concerns that have been simmering in the background.

Adding to the supply-side woes are the issues of diseases such as the swollen shoot, which lacks a cure and necessitates the replacement of cocoa trees—a process that takes up to five years before new cocoa pods can be produced. This long lead time for production recovery is unique to cocoa and poses a significant challenge in quickly responding to high market prices, a common strategy for cultivating annual crops like corn and soybeans.

The Halloween Candy Spending Indicator

A recent indicator of the market’s condition came from the 2023 Halloween season when candy spending soared to a record $3.6 billion. However, this record was attributed more to the effects of inflation, or ‘shrinkflation,’ rather than an increased quantity sold. Notably, Mars’ Galaxy chocolate bars decreased in size by 10%, reflecting a broader industry trend where companies are forced to shrink product sizes or alter recipes to manage costs without excessively increasing retail prices.

Manufacturing Shifts and Consumer Adaptation

The Ivory Coast’s strategic shift towards processing cocoa beans into byproducts like cocoa powder and cocoa butter is an attempt to climb the value chain and enhance profitability amid these challenges. However, this move also signals a potential pivot point for cocoa-consuming countries and manufacturers, who may face increased supply concerns and need to explore alternatives to traditional cocoa usage.

One potential response to high cocoa prices and supply constraints is exploring cocoa alternatives or reducing cocoa content in chocolate products. While offering short-term relief in product cost management, these strategies could alter consumer perceptions and demand for chocolate products.

Price Indices and Market Outlook

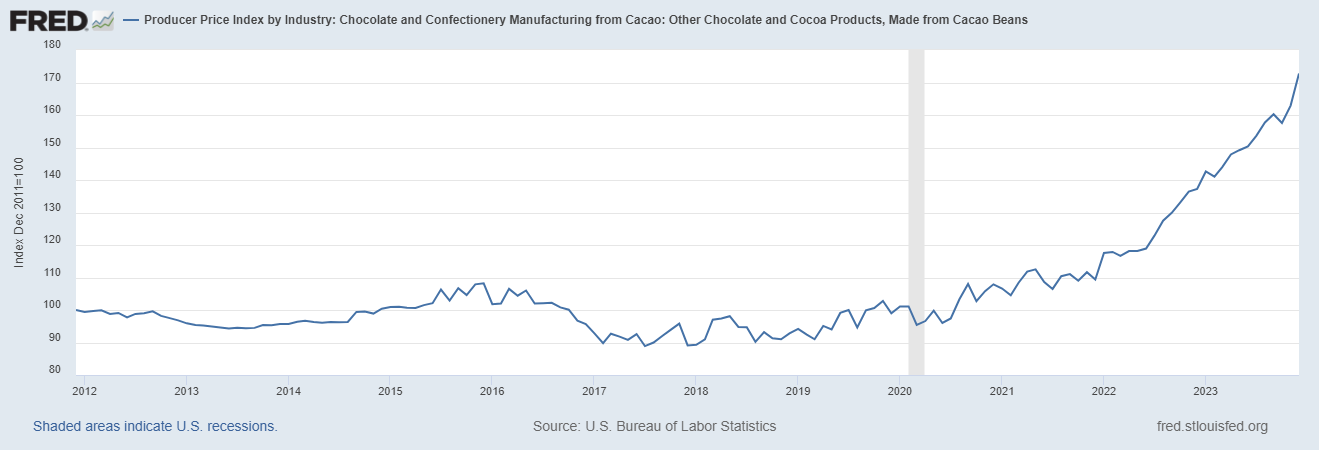

The Producer Price Index (PPI) for Chocolate and Confectionery Manufacturing, which has been rapidly increasing, underscores manufacturers’ increasing cost pressures. If consumer demand softens in response to higher prices or manufacturers adapt by reducing cocoa content, we could see a correction in the market. When that turn could happen, however, is anyone’s guess, as the demand for chocolate products is expected to increase through 2030, according to Skyquest Technology.

Strategic Shifts and Regulatory Actions in the Cocoa Market

As the cocoa market continues to navigate through unprecedented challenges and uncertainties, recent strategic decisions by vital regulatory bodies have underscored the complexity of managing supply and demand dynamics. Notably, the Cocoa Coffee Council (CCC) has taken a cautious approach by halting forward cocoa sales for the 24/25 season until there is greater clarity regarding cocoa production levels. This move reflects a broader strategy to stabilize the market and safeguard the interests of producers amid fluctuating global demand and climatic impacts on crop yields.

Adding another layer of regulatory oversight, the Ivory Coast’s cocoa sector regulator implemented a policy restricting cocoa grinders from accumulating stocks beyond set limits in October. This decision was driven by concerns over potential supply shortages and the risk of missed contracts, highlighting the delicate balance between maintaining operational flexibility and ensuring a steady supply of cocoa beans to meet domestic and international demand.

The Current State of Cocoa Arrivals and Market Implications

Recent data provided by Ange Aboa

on cocoa arrivals at ports in the Ivory Coast, the world’s leading cocoa producer, provides a stark illustration of the industry’s supply challenges. According to exporters’ estimates, cocoa arrivals at ports had reached 1.051 million metric tons by February 4 since the start of the season on October 1, marking a 34% decline from the same period last season. This significant drop in arrivals is further evidenced by the weekly delivery figures, with about 20,000 tons of beans delivered to Abidjan port and 23,000 tons to San Pedro between January 29 and February 4, totaling 43,000 tons—a decrease from 49,000 tons during the same week in the previous season.

Market Responses and Consumer Behavior

The St. Louis Fed’s Producer Price Index for Chocolate and Confectionery Manufacturing quantitatively measures this inflationary trend, showcasing the industry’s rising costs. These cost pressures, if sustained, could lead to a significant shift in consumer behavior, with potential decreases in chocolate consumption or shifts towards alternative products.

The cocoa futures market has witnessed remarkable trends, as illustrated by a historical analysis dating back to 1970. Recent rallies have seen ICE cocoa futures ascend to unprecedented levels, surpassing the $5,240 per ton mark and aiming for historical peaks not seen in over four and a half decades. This surge in cocoa futures highlights the market’s responsiveness to current supply and demand dynamics and sets a new benchmark for pricing expectations.

Interestingly, cocoa demonstrates unique price inelasticity in rising market environments. Traditional economic theory would say that price elasticity should decrease demand for a commodity as prices rise. However, cocoa beans exhibit an exception to this rule, likely due to the insatiable global demand for chocolate. Chocoholics worldwide appear willing to pay a premium for indulgences, underscoring cocoa’s resilience to price elasticity concerns. This phenomenon suggests that even as cocoa prices reach highs not seen in nearly half a century, consumer demand for chocolate products remains robust.

As cocoa and sugar prices soar to levels not witnessed since 2011, the cost implications for confectionery products like cookies and candies are becoming increasingly pronounced. Manufacturers are responding to these cost pressures by adjusting retail prices upwards, a move that is likely to be absorbed by consumers who prioritize the daily pleasure derived from these treats over other discretionary spending. This scenario highlights the complexity between market dynamics, consumer behavior, and strategic decisions within the cocoa industry, setting the stage for a fascinating period ahead as Valentine’s Day and Easter approach.

The Valentine’s Day Effect

Valentine’s Day represents a peak demand period for the chocolate industry, where chocolate’s emotional and cultural significance as a gift amplifies consumption. However, the current economic and supply chain challenges pose a unique scenario for this Valentine’s season. According to Driver Research, consumers will spend approximately $192 this Valentine’s Day.

Will the traditional Valentine’s Day chocolate sales surge withstand the pressures of high prices and supply constraints?

Seasonality and Its Impact on Cocoa Market Futures

The cyclical nature of cocoa futures is a critical market aspect that savvy participants monitor closely. According to Moore Research, cocoa futures exhibit a distinct seasonal pattern, typically experiencing a decline from the end of February through to the low point of the year in mid-April. This period often reflects a temporary easing in market tensions, possibly due to the anticipation of the mid-crop harvest in West Africa, which temporarily alleviates concerns over immediate supply shortages.

However, this downtrend is followed by a significant rally that usually begins post-mid-April and continues until just before the main harvest in September. This rally can be attributed to several factors, including increased demand as chocolate manufacturers ramp production ahead of crucial sales periods such as Halloween and the end-of-year holidays. Additionally, concerns over the size and quality of the upcoming main crop harvest can contribute to market anxiety, driving prices higher.

Strategic Implications of Cocoa’s Seasonal Trends

For investors and traders, understanding the seasonality of cocoa futures provides a strategic edge, allowing for more informed decisions regarding entry and exit points in the market. Producers and cocoa-growing countries can also use this information to better time their sales to maximize revenues, while chocolate manufacturers might plan their cocoa bean purchases to hedge against expected price increases.

Furthermore, the predictability of this seasonal trend could help stabilize supply chain operations by allowing for better inventory management and procurement planning, thereby reducing the risks associated with price volatility. However, it’s essential to note that while seasonality is a consistent pattern, it can be influenced by external factors such as climatic conditions, geopolitical events, or significant changes in consumer behavior, which can occasionally disrupt these expected trends.

Conclusion

The cocoa market’s current challenges and the approaching Valentine’s Day demand peak present a puzzle for the industry. A delicate balance between managing supply constraints, adapting to economic pressures, and meeting consumer expectations. As the industry looks towards Valentine’s Day and beyond, the strategies adopted today will have long-lasting implications on the future of cocoa production, chocolate manufacturing, and global consumption patterns.

Furthermore, the current market structure, characterized by backwardation, hints at expectations for increased production and/or reduced demand leading to lower prices in the future. Yet, the cocoa market remains tight, as evidenced by the significant lag in bean deliveries to Ivorian ports, which, as previously discussed, are over 35% behind this season’s norm. Analysts are predicting a third consecutive deficit year for cocoa, underscoring the ongoing challenges in balancing supply with the relentless demand for this critical chocolate ingredient.

If you enjoyed this article, please visit our blog where we bring research and analysis on the top commodities that drive our world! Blog

Share This Story, Choose Your Platform!

Love’s Price Tag: How High Cocoa Market Costs Could Sour Valentine’s Chocolate

Share This Story, Choose Your Platform

The Cocoa Market

As we approach Valentine’s Day, a key season for cocoa consumption, the cocoa futures market is under intense scrutiny. This period traditionally sees an uptick in demand for chocolate, making it a critical time for producers and investors in the cocoa industry. However, the current market dynamics, influenced by supply constraints, climatic adversities, and evolving consumer behavior, present a complex landscape to navigate.

The cocoa market is currently facing a pivotal juncture, influenced significantly by the supply-side challenges emanating from West Africa, the epicenter of global cocoa production. This region, responsible for over 75% of the world’s cocoa supply, has been hit by a series of climatic challenges that have raised alarms about potential shortfalls in production. The El Niño phenomenon, known for bringing hot and dry conditions, threatens the usual crop cycles, exacerbating the supply concerns that have been simmering in the background.

Adding to the supply-side woes are the issues of diseases such as the swollen shoot, which lacks a cure and necessitates the replacement of cocoa trees—a process that takes up to five years before new cocoa pods can be produced. This long lead time for production recovery is unique to cocoa and poses a significant challenge in quickly responding to high market prices, a common strategy for cultivating annual crops like corn and soybeans.

The Halloween Candy Spending Indicator

A recent indicator of the market’s condition came from the 2023 Halloween season when candy spending soared to a record $3.6 billion. However, this record was attributed more to the effects of inflation, or ‘shrinkflation,’ rather than an increased quantity sold. Notably, Mars’ Galaxy chocolate bars decreased in size by 10%, reflecting a broader industry trend where companies are forced to shrink product sizes or alter recipes to manage costs without excessively increasing retail prices.

Manufacturing Shifts and Consumer Adaptation

The Ivory Coast’s strategic shift towards processing cocoa beans into byproducts like cocoa powder and cocoa butter is an attempt to climb the value chain and enhance profitability amid these challenges. However, this move also signals a potential pivot point for cocoa-consuming countries and manufacturers, who may face increased supply concerns and need to explore alternatives to traditional cocoa usage.

One potential response to high cocoa prices and supply constraints is exploring cocoa alternatives or reducing cocoa content in chocolate products. While offering short-term relief in product cost management, these strategies could alter consumer perceptions and demand for chocolate products.

Price Indices and Market Outlook

The Producer Price Index (PPI) for Chocolate and Confectionery Manufacturing, which has been rapidly increasing, underscores manufacturers’ increasing cost pressures. If consumer demand softens in response to higher prices or manufacturers adapt by reducing cocoa content, we could see a correction in the market. When that turn could happen, however, is anyone’s guess, as the demand for chocolate products is expected to increase through 2030, according to Skyquest Technology.

Strategic Shifts and Regulatory Actions in the Cocoa Market

As the cocoa market continues to navigate through unprecedented challenges and uncertainties, recent strategic decisions by vital regulatory bodies have underscored the complexity of managing supply and demand dynamics. Notably, the Cocoa Coffee Council (CCC) has taken a cautious approach by halting forward cocoa sales for the 24/25 season until there is greater clarity regarding cocoa production levels. This move reflects a broader strategy to stabilize the market and safeguard the interests of producers amid fluctuating global demand and climatic impacts on crop yields.

Adding another layer of regulatory oversight, the Ivory Coast’s cocoa sector regulator implemented a policy restricting cocoa grinders from accumulating stocks beyond set limits in October. This decision was driven by concerns over potential supply shortages and the risk of missed contracts, highlighting the delicate balance between maintaining operational flexibility and ensuring a steady supply of cocoa beans to meet domestic and international demand.

The Current State of Cocoa Arrivals and Market Implications

Recent data provided by Ange Aboa

on cocoa arrivals at ports in the Ivory Coast, the world’s leading cocoa producer, provides a stark illustration of the industry’s supply challenges. According to exporters’ estimates, cocoa arrivals at ports had reached 1.051 million metric tons by February 4 since the start of the season on October 1, marking a 34% decline from the same period last season. This significant drop in arrivals is further evidenced by the weekly delivery figures, with about 20,000 tons of beans delivered to Abidjan port and 23,000 tons to San Pedro between January 29 and February 4, totaling 43,000 tons—a decrease from 49,000 tons during the same week in the previous season.

Market Responses and Consumer Behavior

The St. Louis Fed’s Producer Price Index for Chocolate and Confectionery Manufacturing quantitatively measures this inflationary trend, showcasing the industry’s rising costs. These cost pressures, if sustained, could lead to a significant shift in consumer behavior, with potential decreases in chocolate consumption or shifts towards alternative products.

The cocoa futures market has witnessed remarkable trends, as illustrated by a historical analysis dating back to 1970. Recent rallies have seen ICE cocoa futures ascend to unprecedented levels, surpassing the $5,240 per ton mark and aiming for historical peaks not seen in over four and a half decades. This surge in cocoa futures highlights the market’s responsiveness to current supply and demand dynamics and sets a new benchmark for pricing expectations.

Interestingly, cocoa demonstrates unique price inelasticity in rising market environments. Traditional economic theory would say that price elasticity should decrease demand for a commodity as prices rise. However, cocoa beans exhibit an exception to this rule, likely due to the insatiable global demand for chocolate. Chocoholics worldwide appear willing to pay a premium for indulgences, underscoring cocoa’s resilience to price elasticity concerns. This phenomenon suggests that even as cocoa prices reach highs not seen in nearly half a century, consumer demand for chocolate products remains robust.

As cocoa and sugar prices soar to levels not witnessed since 2011, the cost implications for confectionery products like cookies and candies are becoming increasingly pronounced. Manufacturers are responding to these cost pressures by adjusting retail prices upwards, a move that is likely to be absorbed by consumers who prioritize the daily pleasure derived from these treats over other discretionary spending. This scenario highlights the complexity between market dynamics, consumer behavior, and strategic decisions within the cocoa industry, setting the stage for a fascinating period ahead as Valentine’s Day and Easter approach.

The Valentine’s Day Effect

Valentine’s Day represents a peak demand period for the chocolate industry, where chocolate’s emotional and cultural significance as a gift amplifies consumption. However, the current economic and supply chain challenges pose a unique scenario for this Valentine’s season. According to Driver Research, consumers will spend approximately $192 this Valentine’s Day.

Will the traditional Valentine’s Day chocolate sales surge withstand the pressures of high prices and supply constraints?

Seasonality and Its Impact on Cocoa Market Futures

The cyclical nature of cocoa futures is a critical market aspect that savvy participants monitor closely. According to Moore Research, cocoa futures exhibit a distinct seasonal pattern, typically experiencing a decline from the end of February through to the low point of the year in mid-April. This period often reflects a temporary easing in market tensions, possibly due to the anticipation of the mid-crop harvest in West Africa, which temporarily alleviates concerns over immediate supply shortages.

However, this downtrend is followed by a significant rally that usually begins post-mid-April and continues until just before the main harvest in September. This rally can be attributed to several factors, including increased demand as chocolate manufacturers ramp production ahead of crucial sales periods such as Halloween and the end-of-year holidays. Additionally, concerns over the size and quality of the upcoming main crop harvest can contribute to market anxiety, driving prices higher.

Strategic Implications of Cocoa’s Seasonal Trends

For investors and traders, understanding the seasonality of cocoa futures provides a strategic edge, allowing for more informed decisions regarding entry and exit points in the market. Producers and cocoa-growing countries can also use this information to better time their sales to maximize revenues, while chocolate manufacturers might plan their cocoa bean purchases to hedge against expected price increases.

Furthermore, the predictability of this seasonal trend could help stabilize supply chain operations by allowing for better inventory management and procurement planning, thereby reducing the risks associated with price volatility. However, it’s essential to note that while seasonality is a consistent pattern, it can be influenced by external factors such as climatic conditions, geopolitical events, or significant changes in consumer behavior, which can occasionally disrupt these expected trends.

Conclusion

The cocoa market’s current challenges and the approaching Valentine’s Day demand peak present a puzzle for the industry. A delicate balance between managing supply constraints, adapting to economic pressures, and meeting consumer expectations. As the industry looks towards Valentine’s Day and beyond, the strategies adopted today will have long-lasting implications on the future of cocoa production, chocolate manufacturing, and global consumption patterns.

Furthermore, the current market structure, characterized by backwardation, hints at expectations for increased production and/or reduced demand leading to lower prices in the future. Yet, the cocoa market remains tight, as evidenced by the significant lag in bean deliveries to Ivorian ports, which, as previously discussed, are over 35% behind this season’s norm. Analysts are predicting a third consecutive deficit year for cocoa, underscoring the ongoing challenges in balancing supply with the relentless demand for this critical chocolate ingredient.

If you enjoyed this article, please visit our blog where we bring research and analysis on the top commodities that drive our world! Blog