Will The Bull Run for Cattle Prices Continue?

Share This Story, Choose Your Platform!

Cattle production is the premier agricultural industry in the United States, generating more cash than any other agricultural commodity. The price of beef continues to rise as production struggles to keep up with growing demand. Live Cattle futures have rallied at a steady pace for three years, doubling cattle prices since the start of that run.

Why is Beef so Expensive?

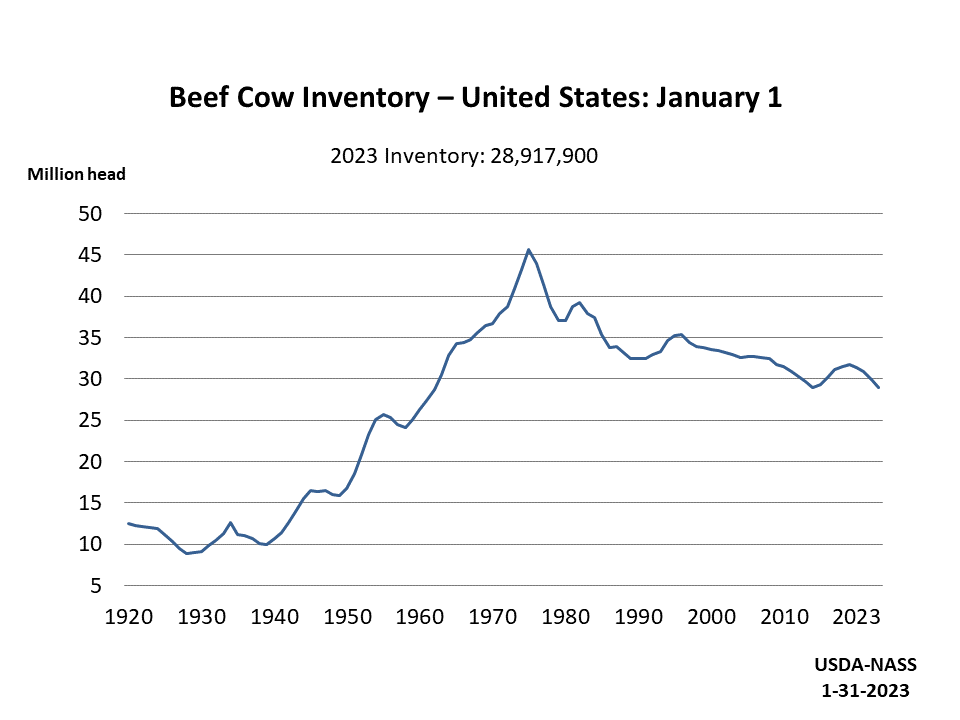

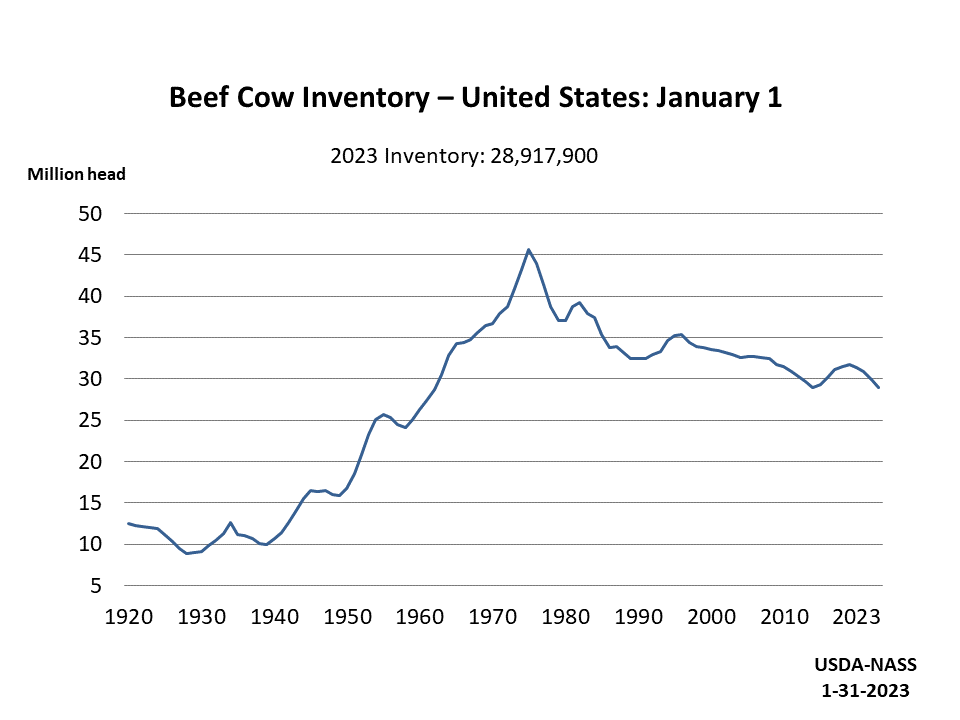

The population of beef cattle in the U.S. tends to grow and decline in cycles which last 8 to 12 years. It was already at a low point in that cycle last year when dry weather devastated grasslands throughout the country. In 2022, 50% of U.S. beef cattle were in a drought zone and the rest were in suboptimal conditions. With sparsely any grass to graze on, and the cost of corn near record highs, ranchers had a difficult time fattening up their herds.

The high price and insatiable consumer demand for beef, combined with expensive grain feed and lack of grass in pastures, left producers with little choice but to send cattle to slaughter earlier and at lower weights than they ordinarily would have. This resulted in the highest cull rate of all time at 13%, which further decimated the national herd.

The U.S. entered 2023 with a total cattle herd – including all beef and dairy bulls, steers, cows, heifers, and calves – of fewer than 90 million head, continuing a multi-decade decline. The forecast for rebuilding that population is limited by the fact that there were only 29 million beef cows, down more than 3.5% from last year and the smallest herd since 1962.

While the average size and total headcount of beef cattle shrank last year, U.S. beef production increased to an all-time high of 28.4 billion pounds. According to the most recent USDA Livestock, Dairy, and Poultry Outlook, beef production will fall to 26.9 billion pounds (a smaller decline than we had initially anticipated, given the current state of the cattle market). In 2024, that figure is anticipated to decline further to 24.7 billion pounds.

As feedlots begin to ramp up their corn purchases – another sign that demand for feeder cattle will remain strong – ranchers have taken creative approaches to restock their inventory. While beef cattle may be in short supply, dairy cattle numbers remain relatively stable, leading to a significant rise in beef-on-dairy (breeding beef bulls with dairy cows).

Expectations are for ample rain this spring that will bring greener pastures and plenty of hay this summer, a great start for rebuilding the herd. However, a serious recovery in population may take another three years. Because the supply of cattle remains tight for the foreseeable future, any near-term price relief would have to come from demand destruction.

Beef, It’s What’s for Dinner Again

Steak and hamburgers are central to American culture. We love them so much that, in addition to being the world’s largest producer of beef, we are also a net importer.

In spite of this, annual beef consumption in the U.S. had been on a multi-decade downward trend, reaching an all-time low of 53 pounds per capita in 2015. That may well have been the bottom, because since then that figure grew to 58 pounds in 2020 and remained above 56 pounds in 2021 and 2022 in spite of sky-high prices.

One reason for this renaissance in beef consumption would have been considered laughable just a decade ago. Today, a growing number of health and fitness influencers promote diets that are high in red meat. Some people with autoimmune issues claim to have been healed by a carnivore diet. Those are small segments of the population, but culturally there seems to have been a slight shift in perception. Red meat is not vilified to the same extent that it was just a few years ago. Will that be enough to sustain demand even as prices continue to rise? It depends on what other options are on the table.

Poultry and Hogs have also seen price increases over the past three years, but not at the same relentless pace as Cattle prices. If the price spread continues to widen we may see more substitution, but so far it has not done much to alter consumer behavior.

Conclusion

With robust demand and constrained supply, we don’t envision a collapse of Live Cattle prices any time soon. The seasonal price trend calls for a summer dip, and falling grain prices in the second half of the year could put the brakes on this rally, but until we see evidence that consumer demand for beef is beginning to wane, we expect Live Cattle prices to remain at or near current levels, with more risk to the upside than to the downside.

Share This Story, Choose Your Platform!

Will The Bull Run for Cattle Prices Continue?

Share This Story, Choose Your Platform

Cattle production is the premier agricultural industry in the United States, generating more cash than any other agricultural commodity. The price of beef continues to rise as production struggles to keep up with growing demand. Live Cattle futures have rallied at a steady pace for three years, doubling cattle prices since the start of that run.

Why is Beef so Expensive?

The population of beef cattle in the U.S. tends to grow and decline in cycles which last 8 to 12 years. It was already at a low point in that cycle last year when dry weather devastated grasslands throughout the country. In 2022, 50% of U.S. beef cattle were in a drought zone and the rest were in suboptimal conditions. With sparsely any grass to graze on, and the cost of corn near record highs, ranchers had a difficult time fattening up their herds.

The high price and insatiable consumer demand for beef, combined with expensive grain feed and lack of grass in pastures, left producers with little choice but to send cattle to slaughter earlier and at lower weights than they ordinarily would have. This resulted in the highest cull rate of all time at 13%, which further decimated the national herd.

The U.S. entered 2023 with a total cattle herd – including all beef and dairy bulls, steers, cows, heifers, and calves – of fewer than 90 million head, continuing a multi-decade decline. The forecast for rebuilding that population is limited by the fact that there were only 29 million beef cows, down more than 3.5% from last year and the smallest herd since 1962.

While the average size and total headcount of beef cattle shrank last year, U.S. beef production increased to an all-time high of 28.4 billion pounds. According to the most recent USDA Livestock, Dairy, and Poultry Outlook, beef production will fall to 26.9 billion pounds (a smaller decline than we had initially anticipated, given the current state of the cattle market). In 2024, that figure is anticipated to decline further to 24.7 billion pounds.

As feedlots begin to ramp up their corn purchases – another sign that demand for feeder cattle will remain strong – ranchers have taken creative approaches to restock their inventory. While beef cattle may be in short supply, dairy cattle numbers remain relatively stable, leading to a significant rise in beef-on-dairy (breeding beef bulls with dairy cows).

Expectations are for ample rain this spring that will bring greener pastures and plenty of hay this summer, a great start for rebuilding the herd. However, a serious recovery in population may take another three years. Because the supply of cattle remains tight for the foreseeable future, any near-term price relief would have to come from demand destruction.

Beef, It’s What’s for Dinner Again

Steak and hamburgers are central to American culture. We love them so much that, in addition to being the world’s largest producer of beef, we are also a net importer.

In spite of this, annual beef consumption in the U.S. had been on a multi-decade downward trend, reaching an all-time low of 53 pounds per capita in 2015. That may well have been the bottom, because since then that figure grew to 58 pounds in 2020 and remained above 56 pounds in 2021 and 2022 in spite of sky-high prices.

One reason for this renaissance in beef consumption would have been considered laughable just a decade ago. Today, a growing number of health and fitness influencers promote diets that are high in red meat. Some people with autoimmune issues claim to have been healed by a carnivore diet. Those are small segments of the population, but culturally there seems to have been a slight shift in perception. Red meat is not vilified to the same extent that it was just a few years ago. Will that be enough to sustain demand even as prices continue to rise? It depends on what other options are on the table.

Poultry and Hogs have also seen price increases over the past three years, but not at the same relentless pace as Cattle prices. If the price spread continues to widen we may see more substitution, but so far it has not done much to alter consumer behavior.

Conclusion

With robust demand and constrained supply, we don’t envision a collapse of Live Cattle prices any time soon. The seasonal price trend calls for a summer dip, and falling grain prices in the second half of the year could put the brakes on this rally, but until we see evidence that consumer demand for beef is beginning to wane, we expect Live Cattle prices to remain at or near current levels, with more risk to the upside than to the downside.